173 THE SIGNIFICANCE OF REAL GDP GROWTH FOR THE INSURANCE DEVELOPMENT

Apstrakt

Insurance has a growing economic and social importance since risks are also very dynamic category. Remediation of damages due to the realization of the risk is imperative because any delay in compensation has additional negative effects. Insurance is a mechanism that compensates and repairs damages in the most efficient way. It can be seen as a consequence but also a lever of economic development. In this article, insurance is being considered as a consequence of economic development. In this regard was performed an analysis of the importance of real GDP growth on the development of the insurance market in OECD member countries. Therefore, three hypotheses assumes the dependence between real GDP growth, gross direct insurance premiums per capita and insurance penetration. A correlation analysis has been conducted to examine the aforementioned dependencies, and the results were interpreted by analyzing the Pearson correlation coefficient. All three hypotheses were proven, with two strong and positive correlations and one moderately positive correlation.

Članak

Introduction

Insurance has an extremely important role in modern living and business conditions. The number of risks faced by individuals and economic entities is is constantly increasing. In addition to new risks, big problem is the growing realization trend of existing risks. The possible realization of risks can cause losses that are sometimes irreparable. (Pearson, 2012). Individuals may lose their assets while businesses companies may disappear from the market. (Diakonidze, 2021; Kelejian et al., 2013). This can have consequences not only on the personal level of individuals, but the entire society can bear the costs of the company's closure. (Kuter et al., 2020). Since employees will lose their jobs, there will be a decline in employment, a rise in dissatisfaction, and a growing distrust.

The intensification of risks realization leads to greater and greater damages that can leave incalculable consequences on GDP growth. This is especially pronounced in countries that are exposed to numerous natural disasters that results in a huge economic and insured losses. If the damages are such that requires a lot of time and financial resources for compensation, the consequences will be also reflected in the GDP decline (Ruiz et al., 2015). Therefore, insurance is necessary because it has proven to be the most effective mechanism for repairing damages. It is widely believed that insurance is a consequence but not the driver of economic development (Baranoff et al., 2013; Franzén et al., 2024). Nevertheless, bearing in mind the effects of insurance on economic development, it is clear that it can also be considered as a lever of economic development (Chiang & Chang, 2012). Despite all this conclusions, numerous studies shows that the development of insurance is conditioned not only by economic development but also by the development of individual consciousness. In developed countries, this consciousness is much more developed than in underdeveloped and developing countries. However, this difference is decreasing in the last decade.

Regardless of the economic importance of insurance, it should be emphasized that its basic functions are: protection, mobilization and allocation of financial resources and a social function (Zweifel & Eisen, 2012). The implementation of these three functions indirectly affects economic development. Although it can be considered as a business arrangement, there are differences, since insurance is actually an investment without an expected return (Alhamid et al., 2024). In this sense, insurance can be considered as an arrangement in which neither of contracting party does not want risk realization.

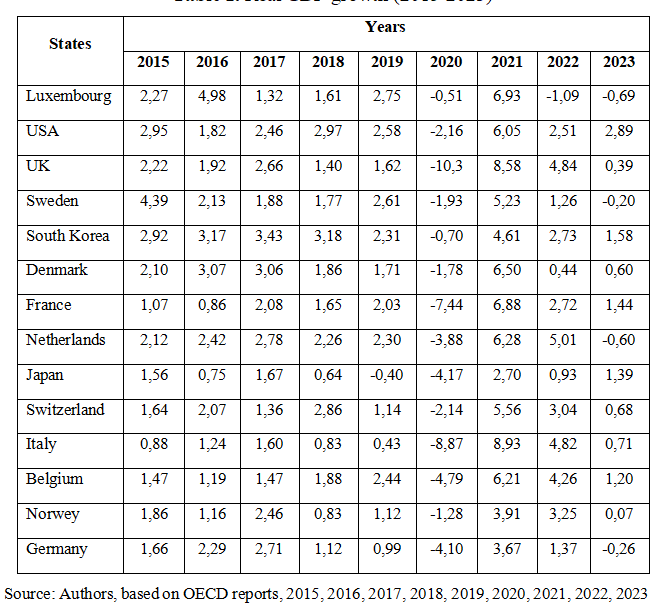

Real GDP growth in OECD countries

Starting from the definition of gross domestic product as the value of all goods and services produced in a certain period of time, it is clear that it is vital for every country to ensure its continuous growth (Watanabe et al., 2018). The connection between GDP growth and economic well-being has been emphasized several times. The following table presents the percentage change in GDP from 2015 to 2023 in several OECD members.

Table 1. Real GDP growth (2015-2023)

According to the data in the table 1, all countries achieved positive GDP growth rates in almost every year. Due to the COVID-19 pandemic in 2020, there is a negative growth rate, i.e. GDP decline in all countries. The biggest decline (10.30%) was measured in the United Kingdom. Decline rates higher than 7% were achieved in Italy and France, 8.87% and 7.44%, respectively. By 2020, all growth rates were positive, with the exception of Japan in 2019. In the period before the COVID-19 pandemic, the highest GDP growth rate was in Luxembourg in 2016 (4.98%), while the GDP growth rate in Sweden in 2015 was at the level of 4.39%. Record GDP growth rates were achieved in 2021, which was expected given the negative GDP decline rates in 2020. The highest growth rates were achieved in the countries that experienced the largest decline in GDP in 2020. In this sense, the United Kingdom, France and Italy should be singled out again, with GDP growth rates of 8.58%, 6.88% and 8.93%, respectively. In the 2022, the GDP growth rates were positive and consolidated in almost all countries, with the exception of Luxembourg (-1.09%). Looking at the initial and final year of the observed period, it is noticeable that GDP growth rates in 2023 are not positive in all countries. It is also evident that growth rates in 2023 are lower than in 2015 in almost all countries. The biggest difference is in Sweden, while only in France is the GDP growth rate in 2023 higher than in 2015.

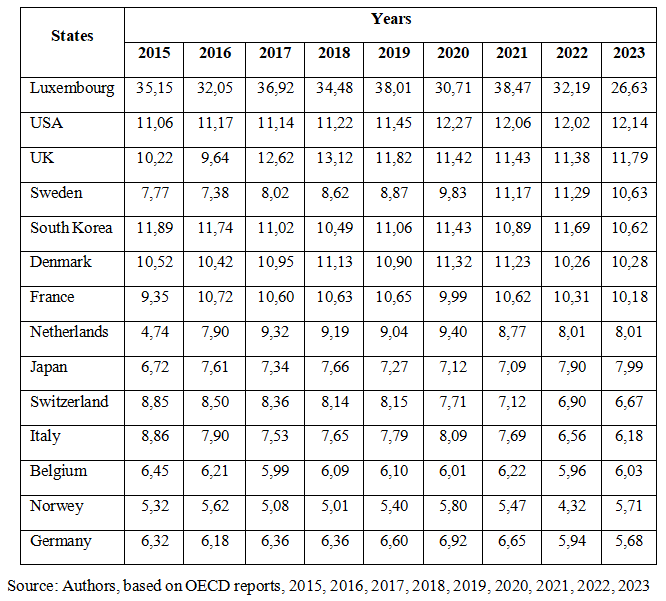

Gross direct insurance premiums per capita in OECD countries

The insurance premium is an element but also a prerequisite for premium insurance (Delcoure & Zhong, 2007). Insurers are motivated to pay premiums because they gain the right for damages compensation whose value will be multiple than the total value of premiums (on a multi-year basis) (Damodaran, 2019; Myers & Read, 2001). This indirectly enables savings for insurers who have suffered damages, making insurance cost-effective (Outreville, 2012). The premium is determined for each insurer separetly, and is determined by the level of insurer risk (Olufunmilayo, 2019). The gross premium represents the total premium that each insurer must pay in order to be entitled to insurance benefits. It consists of the overhead allowance and the net premium (Zweifel & Eisen, 2012).

The values of gross premiums per capita vary depending on the level of development of the insurance market. Globally, those differences can be multiple and even by ten times (Alemany & Guillén, 2013; Thorsten & Webb, 2003). The following table represents gross direct insurance premiums per capita (2015-2023) in OECD member countries. In addition, it should be kept in mind that the values of premiums per capita are primarily determined by the standard of living (Thakor, 1996).

Table 2. Gross direct insurance premiums per capita in thousands of USD (2015- 2023)

According to the data in the table 2, it is evident that gross insurance premiums per capita are the highest in Luxembourg. The record value was achieved in 2021, when gross insurance premiums per capita amounted to 51.84 thousand of USD. After that, a decline was recorded in 2022 and 2023, with gross insurance premiums per capita in 2023 being lower than in 2015. It should be noted that the USA had an increase of the value of gross insurance premiums per capita in every year of the observed period. Thus, in 2023, they are almost 3.6 thousand of USD higher than in 2015. This makes the USA the only country with the constant growth of gross insurance premiums per capita. Overall, in most countries there was a significant increase in gross insurance premiums per capita in the last year compared to the first year of the observed period. This should be certainly attributed not only to the increasing living standard, but also to the growing trust in institutions on the insurance market. It is interesting to emphasize that in Luxembourg, as a country with by far the highest gross insurane premiums per capita, there was a decrease of the value in the last year compared to the first year of the observed period. Beside Luxembourg, such a trend was realized also in Italy and Switzerland.

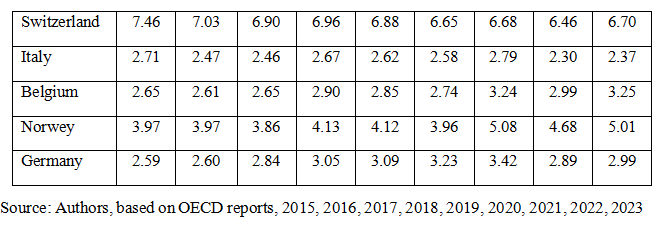

Insurance penetration in OECD countries

Insurance penetration is the ratio of gross insurance premiums to gross domestic product (Vimala & Alamelu, 2018). This ratio indicates the relative importance of insurance in the national economy. (Devindra et al., 2023). Insurance penetration seems to be at the forefront and center of most current discussions about the globaal insurance development.

Numerous studies shows that economically developed countries are also countries with significant insurance penetration (Arena, 2008; Martin & Luhnen, 2010). This enables the fastest possible reaction and remediation of potential damages, which will have additional benefits for economic development. In the underdeveloped countries, situation is completely different, because the insurance markets lag significantly not only in relation to developed economies, but also to the world average. This further complicates the economic prosperity. It should be emphasized that in the 21st century, natural disasters most often affected countries with low insurance penetration (Alhassan, 2016). Since insurance is the most effective mechanism for damages compensation, these consequences are still repaired (Martin & Luhnen, 2010). On the other hand, in countries with high insurance penetration, the consequences are repaired much faster and more efficiently (Luke, 2021). Therefore, high insurance penetration is a goal to strive for because it has multiple positive effects (Ward & Zurbruegg, 2000). The following table presents the share of gross insurance premiums in GDP in OECD member countries.

Table 3. Insurance penetration - percentage of GDP (2015-2023)

According to the data in the table 3, it is noticeable that Luxembourg has by far the largest share of gross insurance premiums in GDP. In almost every year, it is significantly higher than 30%, with the exception of 2023 when this share was below 30%. In 2023 share of gross insurance premiums in GDP was higher than 10% in 7 countries (Luxembourg, USA, UK, Sweden, South Korea, Denmark and France). It should certainly be noted that participation in all countries is at a very high level, because in 2023 only Germany and Norway had less than 6%, which is still significantly above the world average.

If we look at the first and last year of the observed period, it can be noted that not all countries had an increase of the share of gross insurance premiums. Out of a total of 14 countries, growth in participation was achieved in the USA, UK, Sweden, France, Netherlands, Japan and Norway, which is half of those listed in Table 3. In addition, the decline in participation was also realized in 7 countries (Luxembourg, South Korea, Denmark, Switzerland, Italy, Belgium and Germany). The highest growth in the share of gross insurance premiums was achieved in the Netherlands, since the share in 2023 was 8.01%, which is 3.27% more than in 2015. Italy should also be singled out because the participation in 2023 exceeded the participation in 2015 by 2.86%. However, the record change in participation is also negative and refers to Luxembourg, since in 2023 the participation decreased by 8.52%.

Research methodology

The aim of this research is to determine the dependence between several variables, so the adequate and most effective measures can be used to strengthen the insurance market. Therefore, changes in real GDP, insurance penetration, ie. share of gross insurance premiums in GDP as well as gross direct insurance premiums per capita will be subject to statistical analysis. In that sense correlation analysis will be used to determine the degree of mutual dependence between them and the strength of those connections.

One of the measures of correlation is Pearson's correlation coefficient:

rxy = sxy/sxsy (1)

whereby

sxy – covariance

sx2 – variance of the first feature sy2 – variance of the second feature

sxy = ∑xiyi/n - xjyj (2)

sx2 = ∑xi2/n - xj2 (3)

sy2 = ∑yi2/n - yj2 (4)

xj – values of the first feature

xj= ∑xi/n (5)

yj – values of the second feature

yj= ∑yi/n (6)

n – sample size

For the purposes of proving the dependence between the mentioned variables, three hypotheses will be formulated:

H1 – The gross direct insurance premiums per capita depends on the real GDP growth

H2 – Insurance penetration depends on the gross direct insurance premiums per capita

H3 – Insurance penetration depends on the real GDP growth

Results and discussion

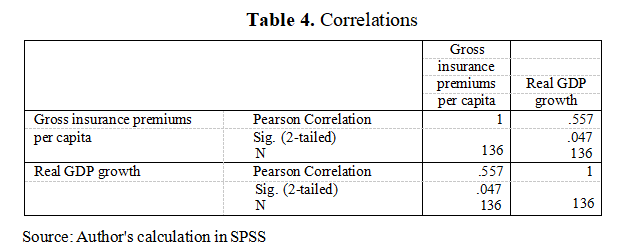

Correlation analysis was performed to test hypothesis H1 that is, dependence of gross direct insurance premiums and real GDP growth. The relationship was interpreted by the Pearson correlation coefficient. Before that, preliminary analyzes were performed in order to prove the fulfillment of assumptions about normality, linearity and homogeneity of variance. The results of the correlation analysis are presented in Table 4.

Table 4. Correlations

A strong positive correlation was calculated between gross direct insurance premiums per capita and real GDP growth, since r = 0,557, n = 136, p < 0,05. Therefore, hypothesis H1 can be accepted, i.e. real GDP growth follows the growth of direct insurance gross premiums per capita and vice versa, real GDP decline follows the decline of direct insurance gross premiums per capita.

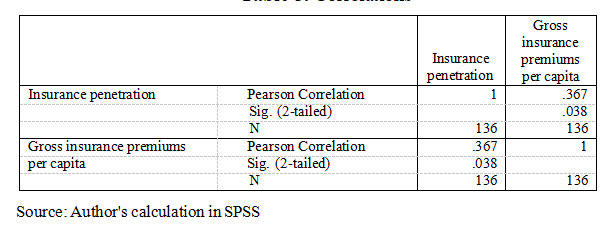

Correlation analysis was also performed to test hypothesis H2 that is, dependence of insurance penetration and gross direct insurance premiums per capita. The relationship was interpreted by the Pearson correlation coefficient. Before that, preliminary analyzes were performed in order to prove the fulfillment of assumptions about normality, linearity and homogeneity of variance. The results of the correlation analysis are presented in Table 5.

Table 5. Correlations

A medium positive correlation was calculated between insurance penetration and gross direct insurance premiums per capita, since r = 0,367, n = 136, p < 0,05. Therefore, the hypothesis H2 can be accepted, i.e. the growth of gross insurance premiums per capita follows the growth of insurance penetration and vice versa, the decrease of gross insurance premiums per capita follows the decrease of insurance penetration.

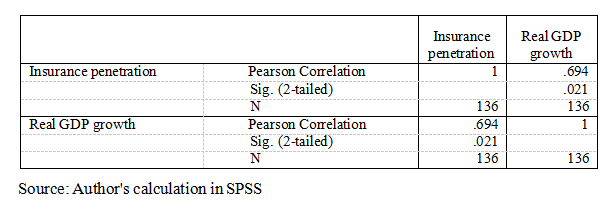

As in the case of the previous two hypotheses, correlation analysis was also performed to test hypothesis H3 that is, dependence of insurance penetration and real GDP growth. The relationship was interpreted by the Pearson correlation coefficient. Before that, preliminary analyzes were performed in order to prove the fulfillment of assumptions about normality, linearity and homogeneity of variance. The results of the correlation analysis are presented in Table 6.

Table 6. Correlations

A strong positive correlation was calculated between insurance penetration and real GDP growth, since r = 0,694, n = 136, p < 0,05. Therefore, the hypothesis H3 can be also accepted, i.e. real GDP growth follows the growth of insurance penetration and vice versa, the real GDP decline follows the decrease of insurance penetration.

Conclusion

Insurance has exceptional increasing importance in modern business conditions and life in general. It is the most effective mechanism for damages compensation.

The speed and efficiency of damages reparation have influence on the all aspects of social life. Inefficient and slow reparation can leave long-term and multiple consequences not only on individuals but also on the economy. The cessation of business operations due to the realization of some risk (fire, flood, earthquake, etc.) affects the existence of employees but also the entire economy. Therefore, insurance in this sense is necessary, because it is a mechanism that will enable a quick and efficient reaction. Regardless of this fact, it cannot be claimed that insurance is equally and globally developed. The fact that insurance can be a lever for economic development is often overlooked.

This article analyzes the dependence between three variables: real GDP growth, gross direct insurance premiums per capita and insurance penetration. Therefore, three hypotheses were formulated and proved. Real GDP growth will affect the growth of gross direct insurance premiums per capita. If GDP growth is interpreted as a parameter of economic development, it is clear that citizens in developed countries will be willing to allocate more funds for insurance. The results of the correlation analysis shows that the growth of real GDP is followed by the increase of insurance penetration. In addition to real GDP growth, insurance penetration is conditioned by the growth of gross direct insurance premium per capita, which again depends on real GDP growth. This proves the importance of GDP growth on the development of the insurance market.

The fact that only OECD member states were analyzed is also a limitation of this research. It would be challenging to implement an analysis that will include many more countries as well as more economic indicators. Also, in addition, a comparative analysis of developed, developing and underdeveloped countries would probably show interesting results. Considering the importance of real GDP growth on the development of the insurance market, this article examines insurance as a consequence of economic development. Therefore, the economic policy makers must be aware that economic developments will have multiplied effects that are reflected, among other things, in the development of the insurance market. Also, the subject of some of the following analyzes may be the economic impact of the development of the insurance market. All of the above points to the inextricable connection and dependence of economic development and the development of the insurance market.

Acknowledgements

This research is supported by the Ministry of Science, Technological Development and Innovation of the Republic of Serbia by the Decision on the scientific research funding for teaching staff at the accredited higher education institutions in 2025 (No. 451-03-137/2025-03/200375 of February 4, 2025).

Reference

2.Alemany, R., & Guillén, M. (2013). The History of the Insurance Market in

Spain. Insurance and Risk Management, 81(1-2), 103-118.

3.Alhamid, A. K., Akiyama, M., Koshimura, S., Frangopol, D. M., & So, H. (2024). Tsunami insurance portfolio optimization for coastal residential buildings under non-stationary sea level rise effects based on sample average approximation. Stochastic Environmental Research and Risk Assessment, 38(3), 817-841.

4.Alhassan, A. (2016). Insurance market development and economic growth: Exploring causality in 8 selected African countries. International Journal of Social Economics, 43(2), 321–339.

5.Arena, M. (2008). Does insurance market activity promote economic growth? A cross-country study for industrialised and developing countries. The Journal of Risk and Insurance, 75(3), 921–946.

6.Baranoff, E. G., Sager, T. W. & Shi, B. (2013). Capital and Risks Interrelationships in the Life and Health Insurance Industries: Theories and Applications. London: Springer.

7.Chiang, L., & Chang, C. (2012). Globalisation and convergence of international life insurance markets. The Geneva Papers on Risk and Insurance - Issues and Practice, 37(1), 125–154.

8.Damodaran, A. (2019). Equity Risk Premiums (ERP): Determinants, Estimation and Implications – The 2019 Edition. NYU Stern School of Business.

9.Delcoure, N., & Zhong, M. (2007). On the premiums of iShares. Journal of Empirical Finance, 14(2), 168-195.

10.Devindra, F., Tharanga, T., Dewasiri, N., Sood, K., Grima, S., & Thalassinos,

E. (2023). Insurance Penetration and Institutional Spillover on Economic Growth: A Dynamic Spatial Econometric Approach on the Asian and Europe Region. Journal of Risk and Financial Management, 16(3), 235-256.

11.Diakonidze, М. (2021). Tourism Insurance Market, Risks and Prospects: The Case Study. Journal of Corporate Governance, Insurance, and Risk Management (JCGIRM), 8(1), 75-83.

12.Franzén, R., Edelman, K., de Andres, G. O., & Lemmetyinen, A. (2024). Navigacija održivosti - unapređenje priobalnog i pomorskog turizma kroz zelene veštine, ko-kreiranje i angažovanje različitih zainteresovanih strana. Menadžment u hotelijerstvu i turizmu, 12(2), 41-57.

13.Kelejian, H., Murrell, P., & Shepotylo, O. (2013). Spatial spillovers in the development of institutions. Journal of Development Economics, 101(2), 297– 315.

14.Kuter, M., Gurskaya, M., & Papakhchian, A. (2020). The Early Practice of Maritime Insurance Accounting in the First Proprietorship of Francesco di Marco Datini in Pisa in 1382–1406. In: Antipova, T., Rocha, Á. (eds). Digital Science 2019. DSIC 2019. Advances in Intelligent Systems and Computing, Springer, Cham., 299-313.

15.Luke, P., Grima, S., Romanova, I., & Spiteri, J. (2021). Fine Art Insurance Policies and Risk Perceptions: The Case of Malta. Journal of Risk and Financial Management, 14(2), 66-95.

16.Martin, E., & Luhnen, M. (2010). Efficiency in the international insurance industry: A cross-country comparison. Journal of Banking and Finance, 34(1), 1497–509.

17.Myers, S.C., & Read, J.A. (2001). Capital Allocation for Insurance Companies. The Journal of Risk and Insurance, 68(4), 545-580.

18.OECD, Gross insurance premiums 2015-2023 (available on https://www.oecd.org/en/data/indicators/gross-insurance-premiums.html)

19.OECD, Insurance penetration 2015-2023 (available on https://www.oecd.org/en/data/indicators/insurance-spending.html)

20.OECD, Real gross domestic product (GDP) 2015-2023 (available on https://www.oecd.org/en/data/indicators/real-gross-domestic-product- gdp.html?oecdcontrol-82d381eddd-var3=2023)

21.Olufunmilayo, А. (2019). Investment Funds, Inequality and Scarcity of Opportunity. Boston University Law Review, 99, 1023-1055.

22.Outreville, J.F. (2012). The Relationship Between Insurance and Economic Development: 85 Empirical Papers for a Review of the Literature. Risk Management and Insurance Review, 16(1), 71–122.

23.Pearson, Р. (2012). World Insurance: The Evolution of a Global Risk Network. Oxford: Oxford University Press.

24.Ruiz, J.R., Stupariu, P., & Vilariño, Á. (2015). The crisis of Spanish savings banks. Cambridge Journal of Economics, 40(6), 1455–1477.

25.Thakor, A.V. (1996). The design of financial systems: An overview. Journal of Banking & Finance, 20(5), 917–948.

26.Thorsten, B., & Webb, I. (2003). Economic, demographic, and institutional determinants of life insurance consumption across countries. The World Bank Economic Review, 17(4), 51–88.

27.Vimala, B., & Alamelu, K. (2018). Insurance Penetration and Insurance Density in India – An Analysis. IJRAR - International Journal of Research and Analytical Reviews, 5(4), 229-242.

28.Ward, D., & Zurbruegg, R. (2000). Does insurance promote economic growth? Evidence from OECD countries. Journal of Risk and Insurance, 67(3), 489–506.

29.Watanabe, C., Naveed, K., Tou, Y., & Neittaanamaki, P. (2018). Measuring GDP in the digital economy: Increasing dependence on uncaptured GDP. Technological Forecasting and Social Change, 137, 226-240.

30.Zweifel, P., & Eisen, R. (2012). Insurance Economics. Berlin: Springer New York.

Objavljeno u

God. 11 Br. 2 (2025)

Ključne reči

🛡️ Licenca i prava korišćenja

Ovaj rad je objavljen pod Creative Commons Attribution 4.0 International (CC BY 4.0).

Autori zadržavaju autorska prava nad svojim radom.

Dozvoljena je upotreba, distribucija i adaptacija rada, uključujući i u komercijalne svrhe, uz obavezno navođenje originalnog autora i izvora.

Zainteresovani za slična istraživanja?

Pregledaj sve članke i časopise