ACTIVITY-BASED COSTING AS A FUNCTION OF INFORMATION SUPPORT FOR MODERN MANAGEMENT

Apstrakt

In the modern business environment, traditional cost accounting methods are increasingly being replaced by advanced approaches that enable more precise cost management and enhance business competitiveness. This paper analyzes the application of contemporary cost accounting methods in the Republic of Srpska, including Activity-Based Costing (ABC). This paper explores the role of ABC as an essential element of information support for contemporary management, emphasizing its contribution to cost optimization, performance evaluation, and strategic planning. The research is based on a survey conducted among accountants to examine their perception of the advantages, challenges, and frequency of applying contemporary cost accounting methods. Descriptive and non-parametric statistical analysis was applied to identify the key factors influencing the selection and implementation of modern cost accounting methods. A particular focus is placed on analyzing the relationship between the degree of enterprise digitalization and the adoption of contemporary cost accounting methods, with special emphasis on the knowledge and application of ABC. The findings provide insight into the current level of adoption of these methods in the Republic of Srpska, as well as the barriers preventing their wider implementation. The study's conclusions are expected to be beneficial to accountants, managers, and decision-makers in selecting optimal methods for improving cost management in enterprises.

Članak

Introduction

The greatest challenges of modern business strategies are not related to formulation, but to the implementation of business strategy. Numerous difficulties arising during implementation stem from constant and unpredictable changes in both the external and internal environments of enterprises. A modern enterprise can achieve a competitive advantage based on sources of value creation (a differentiation strategy), sources of cumulative cost reduction compared to competitors (a low-cost strategy), or both simultaneously (a hybrid generic strategy). In all three cases, managers conduct an in-depth analysis of value drivers and cost drivers. To analyze these drivers and search for other ways to create (and enhance) competitive advantage, managers use proven strategic management techniques. One of the most significant techniques is Michael Porter's (1985) value chain analysis. The focus of the value chain analysis is on activities, which, according to this concept, can be: (1) primary activities (those that follow the physical flow of products and services – such as inbound logistics, operations, outbound logistics, marketing, and services), and (2) support activities (those that provide support for primary activities and each other – such as procurement, technology development, human resource management, and infrastructure). The value chain technique has significantly influenced the evolution of existing and the emergence of new cost planning and accounting systems. In this context, Activity-Based Costing (ABC) and Activity-Based Budgeting (ABB) have emerged. Managing value chain costs under modern business conditions represents a key challenge for organizations aiming to maintain competitiveness and achieve sustainable growth. The value chain encompasses all activities necessary to create and deliver products or services to the end user, and effective cost management in each segment of the chain is a vital success factor. A dynamic business environment, characterized by rapid technological advances and the increasing use of artificial intelligence, market globalization, and growing competition, presents numerous challenges for organizations in managing value chain costs. It is crucial for organizations to recognize these challenges and develop strategies that enable them to manage costs effectively, achieve their goals, and maintain a competitive edge. Intense global competition and technological innovations, combined with changing consumer demands, are forcing businesses to adapt their management approaches, transform production systems, and invest in new technologies.

In the first section of this paper, a review of relevant literature was conducted to identify the key challenges of the business environment in managing value chain costs and to provide a brief summary of the fundamental characteristics of the ABC system. To investigate the prevalence of modern approaches to cost accounting and management in enterprises, a survey was conducted. The respondents consisted exclusively of certified accountants in the Republic of Srpska.

Characteristics of the modern business environment

In the modern business environment, dynamism and unpredictability have become the norm, requiring companies to constantly strive for autonomy, drive improvement, and maintain a healthy financial structure to achieve success. Trends in the business environment demand continuous changes in production processes and management concepts, which also implies adjustments in accounting methods. To keep up with trends, businesses must focus on innovation, entering new markets, and introducing new products. Understanding the new business environment is crucial for the continuous improvement of organizational structure and strategy in order to achieve the set goals (Novićević Čečević, 2016). As a result, organizations are increasingly transitioning from traditional business models to a process-oriented approach, leading to the rise of process-oriented organizations. Process orientation has become a key concept in the business world, focusing on optimizing business processes to achieve greater efficiency and quality (Božić, 2023). By applying Lean principles, such as eliminating unnecessary waste, establishing efficient workflows, and promoting continuous learning and improvement, businesses can achieve greater efficiency, competitiveness, and long-term success. This approach is not limited to production but can also be applied in other sectors, such as services and administration, to achieve similar benefits in improving performance and customer satisfaction (Radosavljević, Bošković & Mihajlović, 2015).

A significant transformation in business structures has been driven by the shift toward process-oriented models, leading to the transition from traditionally vertical organizations to horizontally structured companies. This structure fosters process-oriented management by enhancing information flow, innovation in cost tracking, and performance measurement (Novićević Čečević, 2016). Intense global competition and technological innovations force companies to develop new management approaches and tools, as well as change production systems and invest in new technologies. These dynamics are leading to shorter product life cycles and changes in cost structures, encouraging companies to be more flexible and innovative in addressing the challenges of the modern business environment (Kaličanin & Knežević, 2013).

The emergence of large enterprises with high capital investments, technological innovations, and changing consumer demands are key characteristics of today’s business world, resulting in significant changes in the cost structure of businesses.

The increase in overhead costs relative to direct costs arises from the production and distribution of a wide range of products, the expansion of sales channels, and intensive marketing and research and development activities. Additionally, modern production is characterized by a changed structure and nature of certain costs, which often calls into question the traditional division between fixed and variable costs, along with an increase in overhead costs not directly linked to production volume. In contemporary enterprises, direct labor and material costs, which once played a dominant role, now often constitute a small and declining portion of total production costs due to technological innovations and the discovery of cheaper materials. The automation of production contributes to an increase in fixed costs, while rising fuel prices directly affect the procurement costs of technology. The increase in overhead costs is due to the growth of auxiliary activities beyond direct production, leading to issues with accurate cost calculation and allocation to products. These factors have led to a significant increase in overhead costs within the total cost structure, posing challenges for the accurate determination of product costs, as well as for cost calculation and management (Knežević, 2016).

In the contemporary business environment, in addition to changes in cost structure, there is also a shift in the nature of certain costs. While labor costs were traditionally considered variable, in the new environment, due to uncertainty in production levels, these costs take on a fixed nature (Antić, 2003). Consumers have become the focal point in modern business for several reasons. First, in an intensely competitive world, meeting consumer needs and demands is essential to a company’s survival and growth. Second, the digital revolution and the development of the internet provide consumers with greater access to information, transparency, and choice, making them more powerful than ever before. Furthermore, social media and online platforms offer companies the opportunity to communicate directly with consumers and receive real-time feedback, which is invaluable for adapting products and services to their needs and desires. Finally, the increasing emphasis on personalization and user experience requires companies to pay close attention to consumers to build loyalty and long-term relationships. As a result, process-oriented organizations have emerged, with a focus on consumers in all aspects of their operations. Moreover, the shift from standardized to flexible products allows companies to more easily adapt to consumer needs. Increased product flexibility emphasizes customer satisfaction over functionality, leading to continuous process improvement to meet current and future consumer needs (Kahrović, 2011).

Modern companies can achieve a competitive advantage by efficiently adding value or reducing overall costs compared to their competitors (a low-cost strategy), or by focusing on specific market segments. Managers conduct in-depth analysis of value and cost factors to understand the sources of competitive advantage. By using traditional and modern cost calculation techniques, they explore new ways to improve competitiveness and enhance efficiency, which is crucial for companies in transition (Jablan Stefanović, Knežević & Jugović, 2021). The advantages of a process-oriented organization compared to a traditional structure include a clear view of operations and inter-functional relationships, a focus on customer needs with a simple analysis of their requirements, easier identification of problems such as inefficiencies or bottlenecks, defined responsibilities, improved communication and collaboration between functional units, readiness for change, and process optimization that directly impacts business outcomes (Knežević, Bojović & Vešović, 2008). Organizational structure and production processes in modern companies must continuously adapt to new conditions in the external environment. A process- oriented approach to business emphasizes communication, decentralization, coordination, and teamwork, as opposed to the traditional functional structure. This approach involves reducing hierarchical levels to emphasize collaboration and two-way communication, rather than rigid command structures (Radosavljević, 2016).

The development of information technologies has significantly changed the way we see the world around us. Since the 1990s, the development of information technologies has paved the way for the emergence of a new business concept – the concept of business networks. One of the key aspects of globalization has become the networking of companies, which has been made possible by internet technology and the use of various online applications. For many companies, the advent of the internet has meant a complete transformation of business operations, from procurement and production to sales, distribution, and communication with stakeholders. Artificial intelligence (AI) and rapid technological changes significantly affect cost management and cost accounting systems in several ways. First, the use of AI allows for the analysis of large amounts of data in real-time, enabling more accurate tracking and forecasting of costs. Additionally, the automation of processes using AI can reduce labor costs and increase efficiency. Rapid technological changes are leading to the emergence of new technologies that can optimize production processes and reduce production costs, but at the same time require continuous updates to cost accounting systems to reflect changes in costs and performance. New technologies bring greater flexibility to production processes, work organization, and management, resulting in shorter product life cycles and changes in the cost structure. These changes require adaptation, especially regarding new information processing technologies such as JIT systems and new approaches to business management. This implies new strategies, structures, and tools for coordination and control, representing a new "know-how" technology. Internet technology offers a range of benefits, including a significant reduction in the cost of gathering information and easier access to that information. It also enables quick access to information that facilitates decision-making processes. Furthermore, it accelerates and improves the quality of communication (Knežević, 2016).

With the development of computer systems, accounting information systems have evolved from simple paper books and ledgers to sophisticated databases. However, the application of computer systems often amounts to an efficient replacement for traditional methods, resulting in databases with limited information. The introduction of AI into company computer systems can resolve this issue, enabling systems to perform tasks such as planning and speech recognition, overcoming the limitations of traditional accounting information systems. In the future, the focus will be on analysis rather than just data entry, as although computers can perform analyses, human interpretation remains essential, and human creativity and imagination cannot be replaced by AI programs or robots. It is to be expected that future accounting curricula will include subjects related to programming and using AI for routine accounting functions, which will not only ensure the survival of accounting professionals but also increase their productivity and improve their skills (Mohammad et al., 2020). The integration of AI into ABC systems represents a transformative shift, addressing the limitations of traditional ABC methods in handling complexity and large data volumes. AI- driven ABC systems leverage advanced algorithms, machine learning, and data analytics to enhance cost allocation accuracy, automate routine processes, and provide actionable insights into cost behavior (Chen, 2025).

The scope of accounting information support for ABC systems in modern business conditions

Cost information plays an increasingly important role in management, and costing methods are used to reflect the expenses incurred in the production of goods or services, with ABC standing out for its detailed methodology and precise implementation (Borges et al., 2024).

The ABC approach is based on the idea that activities consume resources and incur costs, while the effects are generated by the activities. First, costs are allocated to activity centers based on their cost drivers. Then, based on the relevant cost drivers, the costs of products or services are determined. In the activities of a company, input resources are transformed into output effects, adding value to the resources to achieve these effects for internal or external users.

A key part of the ABC approach is the proper definition and presentation of activities within the company so that the system functions adequately. This involves identifying activities that consume resources, identifying the cost drivers associated with those activities, allocating overhead costs to those activities, and finally, allocating activities to output effects (Knežević, 2016).

The initial premise is the following: activities consume resources, meaning that activities cause costs, and effects consume activities. In the first step of the ABC approach (activities consume resources or cost elements), costs are assigned to the corresponding activity centers (groups of activities with the same cost drivers) in order to determine the total costs of the activities. In the next step, based on relevant cost drivers, the costs of products, services, or other cost objects are determined. According to the ABC concept, these include: products, services, marketing channels, consumers, processes, activities, etc., depending on the cost accounting objective. In a company’s activities, inputs (resources) are transformed into outputs (effects), adding value to the resources to transform them into effects for internal or external consumers. Proper definition and presentation of activities within the company are essential for the adequate functioning of the ABC system. Therefore, the ABC approach includes: the identification of activities that consume resources; the identification of the cost drivers related to these activities; the allocation of overhead costs to activities, and the allocation of activities to effects (Maher, Lanen & Rajan, 2006). When designing an ABC system, it is essential to ensure the correct definition of activities within the company, the number and nature of the data collected at the activity level, and the appropriate grouping of activities into activity centers. The quality of data about activities (costs, output measures, capacity usage, quality, productivity, investments in activities, etc.) determines the objectivity of measuring the company’s performance. Proper classification of activities is necessary before the ABC system begins to function. This is due to the specific requirements for monitoring and analyzing different activities. Common types of activities include: a) primary and secondary activities - costs of primary activities are directly or indirectly assigned to cost objects, while costs of secondary (supporting) activities are assigned to primary activities; b) value-added activities for consumers and non- value-added activities for consumers - permanent analysis of activities, based on the data of a well-designed ABC system, gives managers the opportunity to decide on the reduction or elimination of the latter (Maher, Lanen & Rajan, 2006);

c) discretionary and necessary activities (Glad & Becker, 1996). The final effect is the cost driver of activities, and cost drivers incurred during activities are factors that cause the costs to arise, i.e., factors or transactions that are significant determinants of costs. Which cost driver will be relevant depends on the specific conditions of the company's operations.

The ABC method complements the traditional cost tracking system, allowing for more accurate cost allocation in an aggressive market environment. It identifies potential for improving production efficiency in a dynamic business environment and enables more accurate estimates of production costs (Petković & Stojkanović, 2021). The final effect is caused by activities, while cost drivers arising from the performance of activities incur costs. When selecting the relevant cost driver, it is important to consider the specific business conditions of the company and the correlation between activity consumption and activity drivers. The ABC approach allocates resource costs to activities based on their consumption drivers, as well as the costs of each activity to cost objects based on their activity drivers (Knežević, 2016). The ABC cost allocation method enables a more objective cost distribution, which is particularly useful in companies with a high proportion of overhead costs.

ABC is therefore today a widely accepted cost accounting system that provides significant support in business, financial, and strategic decision-making (Stratton et al., 2009). The informational content provided by ABC is not only useful in the strategic planning process but also in the implementation of business strategy. Today, as an indispensable technique for implementing and formulating business strategy, the technique known as the Balanced Scorecard (BSC) appears (Đuričin et al., 2014), or in its original form, Balanced Scorecard (Kaplan & Norton, 2001, 2004). In the Balanced Scorecard, desired achievements or objectives are operationalized through metrics that track their realization, and then precise, quantified, and time-bound tasks and actions are defined to achieve them. ABC and BSC represent two modern and complementary concepts (Kaličanin & Knežević, 2013).

Research objective and methodology used

This paper aims to explore the key challenges organizations face in managing value chain costs in the new business environment and to identify the cost accounting approaches being utilized. The paper will subsequently present research findings on the awareness of accountants in the Republic of Srpska regarding new cost accounting approaches. The focus of this research is on understanding how organizations can effectively manage costs across all segments of the value chain to maintain competitiveness and achieve sustainable growth in a dynamic business environment.

The purpose of the survey was to assess accountants’ awareness of new cost accounting approaches and the extent of their application. One of the earliest studies on the adoption of the ABC system was conducted by John Innes and Falconer Mitchell (1995), who sent a survey to various major companies in the United Kingdom to determine the level of adoption of ABC and to examine user perspectives. In 2000, the same authors, along with Sinclair (Innes, Mitchell & Sinclair, 2000), reported that 17.5% of firms in the UK had implemented ABC. Bhimani et al. (2007) later conducted research across seven countries, revealing the following percentages of respondents who utilized ABC across all business units: the UK (55.8%), the USA (54.4%), Germany (50%), Canada (39.1%), Italy (26.3%), France (21.6%), and Japan (6.1%). In 2022, a group of Greek researchers assessed ABC adoption in Greek companies, and explored factors that facilitate and motivate the implementation of this approach. Their findings showed that 10.8% (n=11) of companies used ABC, 8.8% (n=9) had insufficiently considered its future implementation, and 80.4% (n=82) still relied on other cost accounting methods (Kitsantas, Vazakidis & Stefanou, 2022). Additionally, Madwe et al. (2020) highlighted in their research that the primary barriers to ABC implementation include a lack of support from top management, cost structure issues, and other technical factors. The study by Tran and Tran (2022) revealed that indirect cost proportion, competitive pressure concerning price and quality, and product diversification significantly influence a firm's decision to adopt the ABC method. Based on these findings, this study aims to examine the situation in the Republic of Srpska and determine whether modern cost accounting approaches are sufficiently applied.

This research is quantitative in nature and is based on a descriptive survey conducted through an electronic questionnaire. The goal was to examine the degree of application of modern cost accounting methods among accountants in the Republic of Srpska and to identify the key factors that influence their choice. The survey was distributed by e-mail and sent to 148 addresses. The total number of received and valid answers is 81. Considering that, the final research sample consists of 81 respondents, whereby only accountants who have a professional certificate, have at least three years of work experience in the field of accounting and work in companies that have been in business for more than five years are included in the survey. This sample enables a relevant and reliable analysis of the application of modern methods of cost accounting, as it includes only experts with adequate knowledge and practical experience in the field of cost accounting. Although the sample size may seem relatively limited, its specific composition and purposefully chosen criteria make it representative of the researched population. Also, given that the research is not aimed at the entire population of accountants, but at those with defined professional qualifications and experience, the number of 81 respondents is sufficient for valid conclusions. The Kolmogorov-Smirnov test to check the normality of the data distribution. The validity of the sample was further confirmed using non-parametric statistical methods, which are suitable for data analysis in studies with specific and smaller samples. The Kruskal-Wallis test was used to examine the differences between the groups (Ostertagova, Ostertag & Kováč, 2014). The Spearman correlation was used to analyze the relationship between the degree of digitization of the company and the application of modern cost accounting methods. Spearman's correlation coefficient measures the degree and direction of monotonic association between two variables. The value of the coefficient ranges from -1 or perfect negative correlation to +1 or perfect positive correlation (Ali Abd Al-Hameed, 2022). Data analysis was performed using the statistical software package SPSS. Based on the objectives of this research, the following hypotheses were formulated:

H1: There is a statistically significant difference in the degree of digitalization (equipment of companies with adequate IT support for a modern approach to cost accounting) depending on the size of the company.

H2: There is a statistically significant positive relationship between the high level of digitalization of the company and the adoption of modern cost accounting approaches.

H3: The type of company ownership has a statistically significant influence on the choice of cost accounting method.

Research results and discussion

The descriptive analysis of the sample showed that 58% of respondents were female while 42% were male. In terms of age structure, the largest number of respondents in the sample is between 36 and 45 years old (42%), followed by respondents between 26 and 35 years old (27.2%), and then there is a significant participation of respondents between 46 and 55 years old (22%). Respondents aged 18 to 25 years (3.7%) and 56 years and older had the lowest participation with a total participation of 4.9%. In addition to the gender and age of the respondents, the demographic data also included questions regarding the respondents' years of work experience in accounting and finance. A total of 35.8% of the respondents reported having 6 to 10 years of work experience in accounting, followed by 22.2% with 16 and more years of experience. The results show that the largest percentage of surveyed accountants work in companies that have been in existence for more than 30 years (30.9%). A significant share also belongs to companies aged between 21 and 30 years (28.4%), while 24.7% of respondents work in firms that have been operating for 11 to 20 years. The smallest percentage of companies (16.0%) falls into the 5 to 10-year category. These findings indicate that most of the analyzed companies have long-standing business experience, which may influence the adoption of modern cost accounting methods. The descriptive analysis of company size indicates that nearly half of the surveyed accountants (45.7%) work in small enterprises. Medium-sized and large companies are equally represented, with 27.2% of respondents working in each category. The analysis of ownership structure reveals that the majority of surveyed accountants (54.3%) work in private enterprises or organizations. Public (state-owned) companies account for 34.6% of the sample, while 11.1% of respondents are employed in foreign multinational corporations.

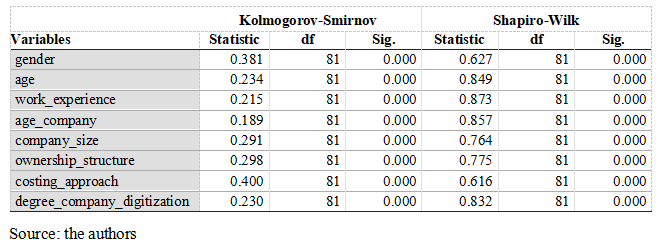

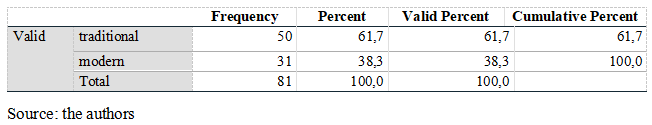

The results indicate that traditional cost accounting methods are more prevalent among the surveyed accountants. Out of 81 respondents, 50 (61.7%) reported using traditional costing methods, while 31 (38.3%) reported adopting modern costing approaches. This suggests that despite the growing emphasis on advanced cost management techniques, traditional methods remain dominant in practice. Before conducting statistical tests, a normality test was first performed to check the distribution of the data. The Kolmogorov-Smirnov test was used for this analysis to determine whether the data were normally distributed (Table 1.).

Table 1. Tests of Normality

Since all the data deviated significantly from the normal distribution (because the p-values are less than 0.05), it can be concluded that the data are not normally distributed.

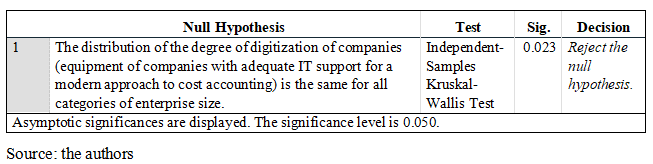

To test the proposed hypotheses, various statistical analyses were conducted. H1 was examined using the Kruskal-Wallis test to determine whether there is a significant difference in the application of modern cost accounting methods based on company size (Table 2.). H2 was tested through Spearman’s correlation analysis, assessing the relationship between the level of digitalization in a company and the adoption of modern costing approaches (Table 3.). Finally, H3 was analyzed using the logistic regression to evaluate the impact of ownership structure on the choice of cost accounting method (Table 4.). These tests provided insights into the factors influencing cost accounting practices among accountants.

Table 2. Hypothesis Test Summary – Kruskal-Wallis test

Based on the conducted analysis, the research results indicate that the size of the company has a significant impact on the degree of digitization, especially in the context of the application of modern cost accounting methods. The rejection of the null hypothesis indicates that the level of digitization differs between small, medium and large enterprises, which suggests that larger enterprises have better conditions for implementing modern digital tools and technologies. Based on the results of the Kruskal-Wallis test, hypothesis H1 is confirmed.

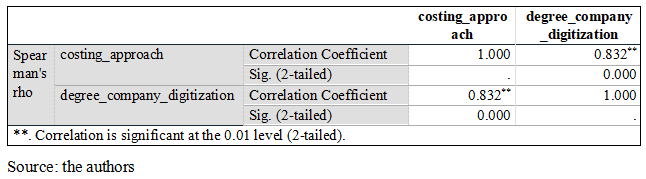

To test hypothesis H2, which concerns the existence of a statistically significant positive relationship between the high level of digitalization of the company where accountants work and the adoption of modern cost accounting approaches, Spearman's correlation method was applied. This test was used to examine the relationship between the variables degree of digitization of company and cost accounting approach. Since these variables are of an ordinal type, Spearman's correlation was appropriate for the analysis.

Table 3. Spearman’s rho test correlations

The results of the Spearman's correlation test confirm that there is a statistically significant positive relationship between the level of digitalization in the company and the adoption of modern cost accounting approaches. Specifically, the correlation coefficient is 0.832, with a p-value of 0.000, which is well below the 0.01 significance level. This indicates a strong positive correlation, meaning that companies with a higher degree of digitalization tend to adopt modern cost accounting methods more frequently. These results confirm hypothesis H2.

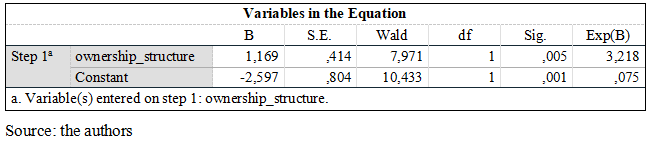

Logistic regression was used to test hypothesis H3. This test was chosen because the dependent variable (costing approach) is binary, with the options “traditional” and “modern”, while the independent variable is ownership type, which is a category. Logistic regression allows for the analysis of the impact of the categories of independent variables on the binary dependent variable.

Table 4. Logistic regression

The regression results show that the type of ownership is a significant predictor of the choice of cost accounting method (p = 0.005). The coefficient B = 1.169 indicates that private or foreign-owned firms are 3.218 times more likely to use a modern costing approach compared to publicly owned firms. These results confirm that the type of ownership has a statistically significant effect on the application of modern cost accounting methods. This confirms hypothesis H3. Private and foreign companies are more likely to adopt modern cost accounting methods compared to public sector companies due to greater flexibility in decision-making, which allows them to implement new technologies and methodologies more quickly. Private companies, driven by profitability and competitiveness, often use modern methods such as ABC to optimize costs and improve operational efficiency, while the public sector faces less pressure for profit and market competition, making the adoption of modern approaches more challenging. Additionally, private and foreign companies have greater resources to invest in technology and training, while the public sector may be constrained by budgets and regulatory frameworks that hinder innovation. The culture of innovation in private companies, along with lower political and regulatory pressures, further facilitates the adoption of modern accounting methods.

In order to investigate which approaches are the most well-known and applicable, an analysis of the survey responses was conducted. The analysis included (Table 5.):

1. traditional cost accounting approaches (actual cost accounting system, standard cost accounting system, variable cost accounting system)

2. modern accounting approaches (cost accounting by activity - ABC, JIT and Backflush, calculation and management of total quality costs - TQM, based on target costs - TCM, life cycle costs - LCCM, through the value chain - VCA, Lean production and value stream accounting - VSA).

Table 5. Frequency – cost accounting approaches: traditional vs modern

Out of the 81 valid responses, 50 accountants (61.7%) use a traditional costing approach, while 31 accountants (38.3%) use a modern costing approach. This indicates that a larger portion still relies on traditional costing approaches.

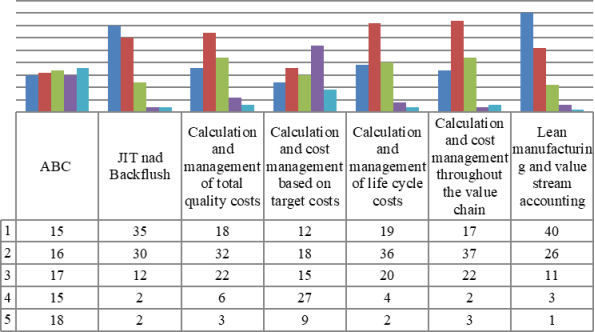

Graph 1. Assessment of respondents' familiarity with modern cost accounting and management methods

Source: Authors

We can conclude that accountants are least familiar with JIT and Backflush systems, as well as with Lean production and value stream accounting, as accounting information support for Lean management. However, the most familiar system reported by respondents was ABC and calculation and management based on target costs, but it is still an insufficient percentage (Graph 1.).

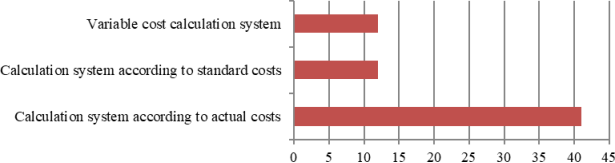

Of the traditional approaches, respondents mostly apply the cost accounting system based on actual costs (41), followed by the variable cost accounting system (12) and the standard cost accounting system (12).

Graph 2. The most applicable traditional cost accounting systems

Source: Authors

Finally, as part of an open-ended question in the survey, accountants were able to express their views on the main challenges of implementing the ABC method. They cite the following as the main challenges:

1. Complexity of implementation - ABC requires detailed mapping of activities and costs, which can be time and resource demanding. Identifying and tracking all relevant activities can be complicated, especially in large or complex organizations.

2. High implementation costs - The introduction of ABC systems implies significant initial investments in software, employee training and adjustment of accounting systems. Maintaining and updating the model can be expensive, especially if business processes change frequently.

3. Lack of professional staff - Accountants and managers are often not sufficiently trained in ABC or are not familiar with its advantages. Lack of internal support and professional knowledge can lead to rejection of the method by employees.

4. Resistance to change - Employees can be resistant to change because traditional costing methods seem simpler and more familiar.

5. Difficulty in collecting data and incompatibility with certain industries.

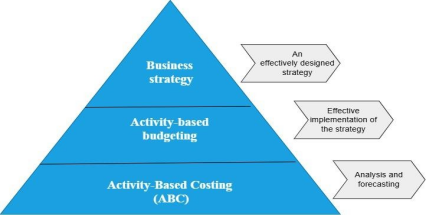

The importance of ABC system information support in the efficient application of business strategy

In addition to numerous scientific literature on modern approaches to costing and cost management, they are rarely applied in practice. As the main reason why they do not apply modern approaches to management and cost accounting, mostly accounting representatives cite the complexity of the production process, but also the desire to maintain the existing cost accounting systems, i.e. the reluctance to innovate. In companies with a traditional corporate culture, changes to the cost accounting system are considered unnecessary or difficult to implement. Resistance to change can be high, especially if employees are used to existing processes. Implementation of modern accounting and cost management systems may require significant investments in infrastructure, software, staff training and changes in organizational structure. High start-up costs can be a barrier for many businesses. This analysis highlights the key challenges that companies face in cost management and shows the need for continuous education and improvement in this area. It also emphasizes the importance of adapting to modern cost management concepts in order to maintain competitiveness in a dynamic business environment. It also highlights the role of relevant institutions, such as the Associations of Accountants and Auditors, as well as educational institutions, in providing support and education in the area of cost accounting. This shows the need for a broader understanding and support in order to improve cost accounting systems and cost management information support in accordance with modern business requirements. It follows that high-quality systems of cost accounting by activities and budgeting by activities can represent the foundations for effective application of business strategy (Graph 3.).

Graph 3. Relationships between business strategy, budgeting by activities and costing by activities

Source: Authors

The implementation of the business strategy includes projecting the needs for financial and human resources. These needs are included in the financial plan for the next fiscal/financial year, that is, the annual budget. In order for the annual budget to be aimed at the realization of adopted strategies and operational business decisions, it is necessary that it consists of two components: a strategic budget for the management of discretionary programs (strategic breakthroughs - new products and services) and an operational budget for the management of business functions and lower organizational units. The operating budget consists of the projected revenues from the sale of products and services and the expenses that are expected to be incurred in order to generate the projected revenues. Current costs, which are included in the operating budget, should ensure the retention of existing consumers and products, as well as the costs necessary for launching new products and attracting new consumers in the following period. The most accurate assessment of these costs is through budgeting by activity. That budgeting takes place in several stages (Kaplan & Norton, 2001, 289-290):

1. assessment of the volume of sales and production in the following period. ABB begins at that stage, just like the traditional budgeting process. It involves evaluating the volume of sales, production, product mix and the number of consumers. However, an ABB should be much more detailed than a traditional budget. For example, it is important here to include information about the processes that are necessary to reach the overall level of production, the number of orders of materials, the method of delivery, etc. When it comes to consumers, it is necessary to evaluate the number of consumer orders, the average size of the order, the number of contacts with consumers, etc.;

2. forecasting the necessary activities. Budgeting by activity continues with the forecasting of necessary activities such as ordering materials, receiving materials, developing new products, selling to consumers, maintaining relationships with consumers. The conventional budget included only some of these activities, such as: purchase of materials, number of working hours of employees, number of machine hours. Activity budgeting extends this analysis to forecast all activities required to produce, sell, and deliver products and services;

3. projection of necessary resources. It is about the projection of all the resources by types and quantities that are necessary for the execution of all the above- mentioned activities. The resource projection uses data on projected activities, on the efficiency of resource use in the past, but also on predictions of possible efficiency improvements;

4. assessment of the costs of using the projected resources. It is about the step in which the cost of using resources and their timing is estimated. This is the most complex step in activity budgeting. With this kind of budget, for example, we are forced to predict the costs of the activity of ordering materials for one month, and then to predict the costs of receiving materials, handling materials, and inspecting materials in the following month.

The complexity of the last stage of the activity budgeting process contributes to the still limited use of this approach to budgeting. This happens despite the great theoretical simplicity of this approach. However, the very process of budgeting by activities can cause a change in managerial behavior in the direction of reducing the size of the company (business unit) for those activities that do not contribute to the creation of value, but also the improvement of those activities in which the greatest value is added. The operating budget, however, does not provide the greatest opportunities for changing the company's strategic direction and aligning the organization with the growth strategy. It is, above all, focused on the implementation of the productivity improvement strategy. A strategic budget is necessary for the implementation of the growth strategy. Many companies fail to implement their strategy precisely because they do not have a strategic budget. A growth strategy cannot be applied, by trying to use existing human and financial resources, already engaged in the implementation of the operating budget. The strategic budget identifies the resources required to implement strategic initiatives to close the gap between the desired performance and the performance that is achievable based on the current way of doing business. This budget identifies new activities, new capabilities, new products and services, which must be launched, new alliances and joint ventures, which must be formed/created.

Conclusion

The application of business strategy implies an analytical approach that directs the attention of managers, in the search for sources of competitive advantage, to the level of activity. In the modern business environment, volatility and unpredictability have become common phenomena, which requires companies to constantly be in a race to achieve autonomy, drive progress and maintain a healthy financial structure in order to achieve success. Tendencies in the business environment require constant changes in production processes and management concepts, which implies adjustment of accounting methods. To keep up with trends, companies need to focus on innovation, conquering new markets and launching new products. Understanding the new business environment is crucial to continuously improve the organizational structure and strategy, in order to achieve the set goals.

The increase in overhead costs compared to direct costs results from the production and marketing of a wide range of products, the expansion of sales channels and intensive marketing and research and development activities. In addition, modern production is characterized by a changed structure and nature of certain costs, which often calls into question the traditional division between fixed and variable costs, with an increase in the share of general costs, which are not directly related to the volume of production. In modern firms, direct labor and material costs, which once played a dominant role, now often make up a small, declining portion of total production costs due to technological innovation and the invention of cheaper materials. The automation of production contributes to the increase in companies' fixed costs, while the increase in fuel prices directly affects the purchase prices of technology. The increase in general costs arises from the growth of auxiliary activities outside of direct production, which leads to the problem of accurate calculation and allocation of costs to products. These factors lead to a significant increase in general costs in the total cost structure, which poses challenges in accurate product pricing, as well as cost accounting and management. Informational support for all new costing approaches is of key importance for their successful implementation. All of this includes the implementation of information systems that enable efficient collection, processing and analysis of data relevant to each specific approach to cost accounting. It also includes staff training to work with new cost accounting tools and techniques, as well as continuous support in the use of information systems to monitor and evaluate results. The integration of IT into accounting functions enables more efficient collection, processing, analysis and presentation of financial data. This support contributes to more efficient cost management and relevant decision- making in order to improve the company's performance. The use of specialized accounting software enables the automation of many accounting processes, including bookkeeping, financial reporting, invoice management and expense records. The implementation of Activity-Based Costing (ABC) as an information support tool for modern management significantly enhances the accuracy and relevance of cost data, enabling better decision-making and strategic planning. By allocating costs based on actual resource consumption, ABC provides managers with a clearer picture of operational efficiency and profitability. Furthermore, its integration with modern information systems facilitates real-time data processing and more precise financial analysis, fostering a more agile and competitive business environment. However, organizations that successfully adopt ABC can achieve better cost control, improved performance measurement, and enhanced strategic alignment. Ultimately, ABC represents a valuable tool for contemporary management, contributing to the optimization of business processes and the sustainable growth of organizations in an increasingly complex and dynamic market.

Traditional cost accounting systems dominate in Republic of Srpska, while modern approaches are rarely applied, mainly due to resistance to changes and process complexity, whereby we conclude that the practical application of modern approaches lags behind the theory. Challenges include high initial implementation costs, resistance to change and lack of adequately trained staff. Continuous education and support from adequate institutions is needed in order to raise awareness of newer and more modern approaches to cost calculation and management, as well as the benefits of their application. The key is to adapt to modern concepts in order to maintain competitiveness in a dynamic business environment.

The results of this research indicate significant factors that influence the choice of cost accounting methods in companies. First, it was determined that there is a statistically significant difference in the degree of digitalization of companies depending on their size, with larger companies showing a higher level of digitalization, which enables them to apply modern cost accounting methods more easily. Second, the results of the Spearman correlation confirm the existence of a positive relationship between a high level of digitalization and the application of modern cost accounting methods. This indicates that companies that invest in digitization and IT support are more likely to use more modern approaches to cost accounting, which can contribute to more efficient financial management. Third, the logistic regression showed that the type of company ownership has a statistically significant effect on the choice of the cost accounting method. Privately and foreign-owned companies are significantly more likely to use modern costing methods compared to public companies. This result can be explained by the greater orientation of the private sector towards efficiency, competitiveness and cost optimization.

One of the main limitations of this study is the relatively small sample size, which may affect the generalizability of the results. Additionally, the research was conducted within a specific sector and geographic area, meaning a broader sample could provide a more comprehensive picture. Furthermore, the data were collected through a survey questionnaire, which carries the risk of subjective responses from participants. For future research, it is recommended to expand the sample to different industries and countries to obtain comparative results. Additionally, the use of qualitative methods, such as interviews or case studies, could provide deeper insights into the factors influencing the adoption of modern cost accounting methods. Moreover, it would be valuable to explore the long-term effects of digitalization and ownership structure on business efficiency and profitability.

Reference

Antić, L. (2003). Obračun troškova po aktivnostima u funkciji upravljanja savremenim preduzećima (Vol. Doktorska disertacija). Niš: Ekonomski fakultet Niš.

3.Bhimani, A., Gosselin, M., Ncube, M. & Okano, H. (2007). Activity-Based Costing: How Far Have We Come Internationally? Journal of Cost Management, 21(3), 12-7.

4.Borges, P., Alves, M. D. C., & Silva, R. (2024). The activity-based costing system applied in higher education institutions: a systematic review and mapping of the literature. Businesses, 4(1), 18-38.

5.Božić, K. (2023). Značaj usavršavanja i obuke zaposlenih za unapređenje zrelosti procesno orijentisane organizacije. International Scientific Conference Smart and Sustainable Economy: Trends and Perspectives (pp. 254-263). Niš: Faculty of Economics, University of Niš.

6.Chen, B. (2025). Leveraging Advanced AI in Activity-Based Costing (ABC) for Enhanced Cost Management. Journal of Computer, Signal, and System Research, 2(1), 53-62.

7.Đuričin, D., Janošević, S., & Kaličanin, Đ. (2014). Management and strategy.

(9th ed.). Faculty of Economics. Belgrade.

8.Glad, E., & Becker, H. (1996). Activity Based Costing and Management. John Wiley and Sons LTD, England.

9.Innes J., Mitchell F. (1995). A survey of activity-based costing in the U.K.’s largest companies. Management Accounting Research, 6(2), 137–153. https://doi.org/10.1006/mare.1995.1008

10.Innes, J., Mitchell, F., & Sinclair, D. (2000). Activity-based costing in the U.K.'s largest companies: A comparison of 1994 and 1999 survey results. Management Accounting Research, 11(3), 349-62.

DOI:10.1006/mare.2000.0135

11.Jablan Stefanović, R., Knežević, V., & Jugović, J. (2021). Informacije o troškovima u funkciji podrške unapređenju konkurentskih prednosti preduzeća.

12.Kahrović, E. (2011). Tradicionalno vs. procesno orijentisana preduzeća u funkciji povećanja efikasnosti. Operacioni menadžment u funkciji održivog ekonomskog rasta i razvoja Srbije 2011-2020.

13.Kaplan, R., Norton, D. (2001). The Strategy - Focused Organization: How Balanced Scorecard Companies Thrive in the New Business Environment. Harvard Business School Press, Boston, Massachusetts.

14.Kaplan, R., Norton, D. (2004). Strategy Maps: Converting Intangible Assets into Tangible Outcomes. Harvard Business School Press. Boston, Massachusetts.

15.Kaličanin, D., & Knežević, V. (2013). Activity-based costing as an information basis for an efficient strategic management process. ECONOMIC ANNALS, Volume LVIII, 95-119.

16.Kitsantas, T., Vazakidis, A., & Stefanou, C.J. (2022). Factors That Facilitate And Motivate The Adoption And Implementation Of Activity Based Costing In Greek Companies. Advances in Business Related Scientific Research Journal.

17.Knežević, V. (2016). Organizaciono-metodološki problemi obračuna i upravljanja troškovima lanca vrednosti. (D. disertacija, Ed.) Beograd: Univerzitet u Beogradu, Ekonomski fakultet.

18.Knežević, N., Bojović, N. i Vešović, V. (2008). Organizaciona struktura procesno orijentisane organizacije. XXVI Simpozijum o novim tehnologijama u poštanskom i telekomunikacionom saobraćaju.

19.Madwe, M. C., Stainbank, L. J., & Green, P. (2020). Factors affecting the adoption of activity-based costing at technical and vocational education and training colleges in KwaZulu-Natal, South Africa. Journal of Economic and Financial Sciences, 13(1), 1-10. DOI:10.4102/jef.v13i1.467

20.Maher, M., Lanen, W., Rajan, M. (2006). Fundamentals of Cost Accounting. McGraw-Hill Companies, Inc. New York.

21.Mohammad, S. J., Hamad, A. K., Borgi, H., Thu, P. A., Sial, M. S., & Alhadidi, A. A. (2020). How artificial intelligence changes the future of accounting industry. International Journal of Economics and Business Administration, 8(3), 478-488.

22.Novićević Čečević, B. (2016). Upravljačko-računovodstvena podrška menadžmentu preduzeća u lean poslovnom okruženju. Doktorska disertacija. Univerzitet u Nišu, Ekonomski fakultet.

23.Ostertagova, E., Ostertag, O., & Kováč, J. (2014). Methodology and application of the Kruskal-Wallis test. Applied mechanics and materials, 611, 115-120.

24.Petković, Z., & Stojkanović, D. (2021). Application of ABC analysis as a modern method of cost management. Zbornik radova Računovodstvo i revizija u teoriji i praksi. Banja Luka College, 87-98. DOI: 10.7251/BLCZB2101087P

25.Porter, M.E. (1985). Competitive Advantage. Free Press. New York.

26.Radosavljević, M. (2016). Upravljenje poslovnim procesima primjenom modela zrelosti. Niš: Ekonomski fakultet Univerziteta u Nišu.

27.Radosavljević, M., Bošković, G., & Mihajlović, M. (2015). Procesna orijentacija kao akrika između upravljanja ukupnim kvalitetom i lean menadžmentom. Poslovna ekonomija, 9, 277-294.

28.Stratton, W.O., Descroches, D., Lawson, R., Hatch, T. (2009). Activity-Based Costing: Is It Still Relevant? Management Accounting Quarterly, Spring, Vol. 10, No. 3, 31-40.

29.Tran, U. T., & Tran, H. T. (2022). Factors of application of activity-based costing method: Evidence from a transitional country. Asia Pacific Management Review, 27(4), 303-311.DOI: 10.1016/j.apmrv.2022.01.002

Objavljeno u

God. 11 Br. 2 (2025)

Ključne reči

🛡️ Licenca i prava korišćenja

Ovaj rad je objavljen pod Creative Commons Attribution 4.0 International (CC BY 4.0).

Autori zadržavaju autorska prava nad svojim radom.

Dozvoljena je upotreba, distribucija i adaptacija rada, uključujući i u komercijalne svrhe, uz obavezno navođenje originalnog autora i izvora.

Zainteresovani za slična istraživanja?

Pregledaj sve članke i časopise