ACCOUNTING ASPECT OF INCOME IN FINANCIAL BUSINESS

Abstract

Income is the gross inflow of economic benefits during the accounting period, which results from the regular activities of a business entity and which results in an increase in its capital, except for increases related to the contributions of capital owners. There are different names for certain types of income: income from sales, commissions, interest, dividends, royalties. The standard is applied for the accounting inclusion of income arising from the following transactions and events: sale of goods, provision of services and use of assets of the business entity by others, which generate income in the form of interest, royalties and dividends. The framework and almost all IAS and IFRS refer, in part, to revenues, in terms of their: definition, origin and structure: accounting coverage. Therefore, the question can be raised whether IAS 18 is not a repetition of what other accounting standards and the Framework contain about income.

Article

Introduction

Generally speaking, revenues are recognized when: it is probable that future economic benefits will flow to the business entity and when their amount can be reliably determined. Revenues are valued at the gross fair value of the received compensation or receivables, less trade discounts and rebates. IAS 18 is consistent with regard to the definition of income and the principle of the occurrence of a business event, as a condition for the recognition of income, and it does not offer any new knowledge in relation to other standards and the Framework. The standard starts from the definition, from the Framework, that income is an increase in economic benefits during the accounting period in the form of an inflow or increase in assets or a decrease in liabilities, which result in an increase in capital, not counting the increase based on the payments of participants in the capital.

This standard deals with income "inside", ie. has in mind that income is generated in various ways, i.e. that business events are different and that their origin is not clear-cut and therefore neither are incomes.

IAS 18 deals not only with whether income can be recognized but also when it can be recognized, i.e. whether the event actually occurred and how its occurrence can be expressed through income. For example, if the installation of the equipment has not been carried out, and it is an integral part of the transaction or business event (according to IAS 18), there are no conditions for recognizing revenue even though the equipment has been delivered (ASB, 2003). This is not a deviation from the principle of the occurrence of a business event, but only its complete identification in the function of the established recognition of income.

The aim of the paper is to explain the changes in other standards for the application of this standard in relation to: what can be recognized as income from certain business events or economic transactions; when income can be recognized and accounted for. The standard for revenue recognition is based on the criteria of the Framework, with the fact that it identifies the circumstances in which those criteria will be met, in order for the revenue to be recognized.

This standard refers to revenues generated from: sales of goods; performance of services; interest, royalties and dividends for funds provided for use by other persons. Goods are understood to mean: products produced by a legal entity for sale; goods purchased for resale; land and other real estate held for resale. The provision of services under one contract may last for several accounting periods (Camfferman & Zeff, 2015). If these services are connected within the construction contract, such as engineering and design services, that income is not processed within this standard, but is calculated in accordance with IAS 11. Income based on assets given for use to another entity are: interest – compensation for the use of cash, or cash equivalents, or for amounts owed to a legal entity; royalties for the use of long-term assets of a legal entity (patents, trademarks, copyrights and computer software); dividends from shares in the capital of legal entities or banks, except for dividends from affiliated legal entities.

Valuation and recognition of income from the sale of goods

The standard uses the concept of gross income, which means the full amount of income without offsetting or reporting in net amounts, but not the parts that refer to third parties, such as value added tax, etc.

Revenue is measured at the fair value of the consideration received or consideration claimed. The amount of income based on a business transaction, such as: the sale of goods and the performed service, is determined by an agreement between the seller and the buyer, that is, the user of the service. This agreed amount is expressed in the nominal amount of the received compensation or claim, without any trade discounts and rebates agreed upon during the purchase and sale, and generally corresponds to the fair value of the received compensation or claim (Christensen & Nikolaev, 2017). This is in accordance with the stated request.

Deviations from fair value are possible if the contracted nominal fee is paid on a delayed basis, without interest or with interest that does not compensate for changes in the value of money over time. In that case, the fair value of the compensation may be lower than the nominally contracted amount that is claimed. For example, if the payment is made after one year in the agreed nominal amount of, for example, 100,000 dinars, then the fair value of the compensation for the delivered goods is less than the agreed price, approximately by the amount of one year's interest included in some placement that after one year provides together with a capital inflow of 100,000 dinars. When contracting a deferred payment based on a business and financial transaction, the fair value is determined at the level of the net present value. It is obtained by discounting all future receipts using an interest rate, which can be determined as the interest rate that is most common for a similar instrument of an issuer with similar creditworthiness, or as an interest rate that discounts the nominal amount of the instrument to the current cash price of selling goods or services (IASB, 2018).

The fair value of the sold goods determined in this way is recognized in the income of the accounting period when the goods are sold. The difference is recognized as interest income in the accounting periods in which the collection of deferred installments is due.

When goods or services are exchanged for other goods or services, then the income is measured according to the fair value of the goods or services received. If the fair value of the goods or services received cannot be reliably determined, the income is determined according to the fair value of the goods or services sold (Zeff, 2018).

If the same or similar goods or services are exchanged in terms of nature and value, this exchange is not considered to generate income. An example of such an exchange is when legal entity "A" from Belgrade and legal entity "B" from Kruševac exchange the same type of goods in order to complete the assortment of goods in the stores of legal entity "A" in Kruševac and the stores of legal entity "B" in Belgrade.

The basic issue is identifying the transaction, i.e. when income can be recognised, which is what this standard insists on, based on the large differences in the realization of income by various legal entities and various ways of carrying out the realization of a job (Amacha & Dastane, 2017).

The income per transaction was realized as a whole when the process of delivering the goods was completed. In certain circumstances, it is necessary to apply recognition criteria to the components of a transaction (Savić & Bonić, 2022). The transaction may include the delivery of goods and assembly or service obligations. The delivery of the goods is then one component of the transaction. Assembly is another. Servicing is the third component of a transaction. The meaning of the requirements of the standard is to identify the part of the income that refers to, in this case, the second and third components and to make that part of the income according to the execution of those components of the transaction.

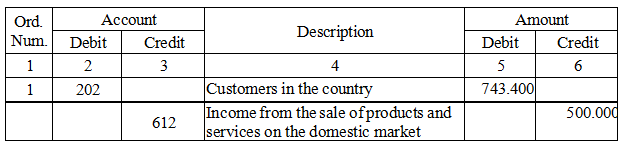

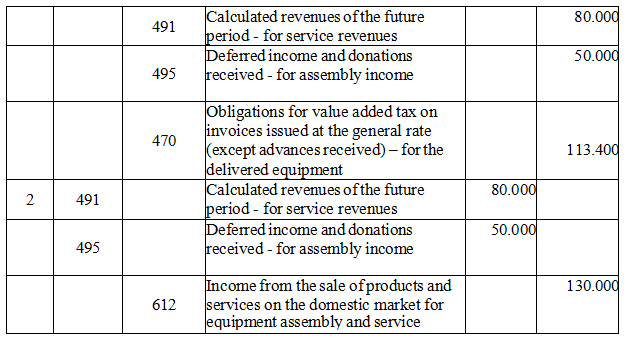

Example:

The product, i.e. the equipment, was delivered with the obligation of installation and servicing within a warranty period of 12 months from the day of installation. The total value of the transaction is 630,000 dinars. VAT of 18% is calculated on it. The customer has confirmed receipt of the equipment and the invoice.

In accordance with the requirement of IAS 18:

- the invoice value of the machine of 500,000 dinars is paid on the day of delivery;

- the value of the assembly service of 50,000 dinars is earned on the day of the completed assembly;

- the service value of 80,000 dinars is paid according to the contract, for example, quarterly or after the warranty period expires, regardless of whether there was an expected volume of servicing.

Posting:

Production can be long-term (for example, building a ship or an industrial facility) and extend over several accounting periods. These differences are differences in the assessment of the occurrence of the event, which is a condition for the recognition of income. Income is created and it does not have to be disputed whether it exists, but it is a matter of determining the moment when it can be determined and recognized.

Sale of goods - Income from the sale of goods should be recognized (paragraph 14) if all the following conditions are met (Dutta et al., 2020):

- when the legal entity has transferred to the buyer significant risks and benefits from the ownership of the goods;

- when the legal entity does not retain direct participation in the management resulting from ownership, nor does it retain control over the goods;

- when the amount of income can be reliably measured;

- when it is likely that the economic benefits from the transaction will flow to the legal entity;

- when the costs that have already been incurred or will be incurred in connection with the transaction can be reliably measured.

Fulfillment of the first condition depends on the transaction. This is realized immediately in the sale of goods, i.e. in retail sales - when the sold goods are charged immediately (Savić et al., 2024). There are also such transactions in which, due to the nature of the object of sale or delivery, risks based on ownership are necessarily retained. That transaction cannot be considered as a basis for revenue recognition.

Examples of such situations are (Hindasah & Nuryakin, 2020):

- when a legal entity has undertaken an obligation for possibly unsatisfactory performance, which is not covered by a guarantee;

- when the collection based on the sale is conditional on the income that the buyer should realize from the sale of his goods;

- when the subject of the contract is the installation of the sold equipment, and this obligation has not yet been fulfilled;

- when the buyer has a contractual right to cancel the purchase of goods, which is why the seller assumes such a possibility.

There are also situations when retaining control of the goods sold is not a limitation for revenue recognition. If it is agreed that the seller retains ownership of the goods in order to ensure their payment, and that all other rights and risks are transferred to the buyer, in that case it is a sale transaction and there are conditions for revenue recognition (paragraph 17). Revenue may also be recognized if, for example, it is probable that part of the goods will be returned, if the seller can reliably estimate future returns and recognize a liability for returns based on past experience and other factors (IAS 37).

Until there is a sufficient probability that economic benefits will flow to the legal entity based on the transaction (which is a key criterion for revenue recognition), revenue recognition is deferred. For example, the collection of exported goods may be uncertain, due to measures prohibiting the transfer of funds from the authorities of a foreign country, while all other conditions for the recognition of income are met. Then there is no probability of an inflow of economic benefit to the legal entity based on that sale. When the uncertainty is removed, income can be recognized (paragraph 18). A distinction should be made between this uncertainty and the uncertainty of collection of already recognized income. In the second case, there was a condition for recognition of income at the moment of delivery of the goods. Income income is not canceled, but an expense is recognized in the amount of the probably uncollectible amount (Plumlee et al., 2015).

Income and expenses for the same transaction are recognized simultaneously (matching of income and expenses). Warranty costs and other costs that may follow the delivery of goods can usually be predicted and measured, when other conditions for revenue recognition are met. Income cannot be recognized when expenses cannot be reliably measured. In such circumstances, any compensation received should be treated as an advance liability (paragraph 19).

It can be concluded that the recognition of income requires a careful and individual assessment of each transaction, in terms of whether the conditions from paragraph 14 are met, i.e. whether the process of earning income from the sale of goods or products is completed or mostly completed, so that, with certain provisions for subsequent foreseeable expenses, the recognition of income and related expenses could be done (Sugiyanto & Sumantri, 2019).

Provision of services - There are services that are performed in a shorter period of time. Income and expenses related to a specific service are recognized at the time of completion of the contracted service. There are services, such as those in the field of investment construction, when the execution of the entire contracted service requires time longer than one accounting period. Respecting the principle of the occurrence of a business event or transaction, it may be necessary to recognize income and associated costs of the period in those cases as well.

When the result of a transaction involving the provision of services can be reliably estimated, revenue should be recognized according to the degree of completion of the transaction at the balance sheet date (paragraph 20). The result of the transaction, in terms of realized income, can be reliably estimated when the following conditions are met (Astami et al., 2017):

- if the amount of income can be reliably measured;

- if it is likely that the economic benefits related to the performance of the service will flow into the legal face;

- if the degree of service completion by the balance sheet date can be reliably measured;

- if the incurred costs, due to the performance of the service up to the date of the balance sheet, can be reliable measured.

The recognition of income according to the degree of completion, which is expressed as a percentage of the total contract price, enables the income to be recognized in the accounting period when it is realized. Revenue recognition, on this basis, is dealt with by IAS 11. The requirements of that standard are in agreement with this standard (paragraph 21).

As in the case of income from the sale of goods, the uncertainty in the collection of all or part of the claim, arising when the service has already been performed and the income recognized, is accounted for as an expense based on the correction of the claim, and not as a reversal of income (paragraph 22).

The legal entity is able to reliably assess the probability of economic benefits from the performance of the service (paragraph 23), if they have been agreed with the other contracting party (Donatella et al., 2019):

- the rights of the contracting parties;

- fees to be exchanged;

- method and conditions of settlement of the obligation. The degree of completion can be determined by:

- by inspecting and comparing the completed work according to the total work;

- according to the hours of work spent in relation to the total planned hours of work for the execution of the contracted work;

- according to realized costs in relation to planned costs (paragraph 24).

If it is not possible to reliably measure the performance of the service (which may be the case in the earlier stage of performance, when additional jobs appear whose contracting or recognition by the service user is yet to follow, so the outcome is uncertain), income should be recognized only up to the amount of incurred recoverable costs ( paragraph 26 and 27).

If there is a high degree of uncertainty regarding the collection of the work performed due to, for example, the investor's bankruptcy, the unpaid part of the service is not recognized as income, and the incurred costs are charged to the expenses of the period (Stankov & Roganović, 2022; Savić et al., 2023). When the uncertainty is removed, revenues are recognized (paragraph 28) within the amount receivable.

Valuation and recognition of income from interest, royalties and dividends

Interest, royalties and dividends - Income based on the funds of a legal entity used by another entity, in the form of interest, royalties or dividends, should be recognized (paragraph 30) under the condition (Zalata et al., 2018):

- that it is likely that the economic benefits associated with these transactions will flow to the legal entity;

- that the amount of income can be reliably measured.

These revenues should be recognized (paragraph 30) on the following basis (Svabova et al., 2020):

- interest should be recognized using the effective interest rate method, in accordance with IAS 39;

- royalties for the use of funds should be recognized on the principle of occurrence of the event, in accordance with the contract;

- dividends are recognized when the shareholder's right to receive dividend payment is established, i.e. when the decision of the competent authority paying the dividend is made, and not when the dividend is received.

The effective interest rate is the interest rate that equates the present value of future income, during the lifetime of the asset or debt repayment, with the initially stated amount of the asset (Dašić et al., 2023).

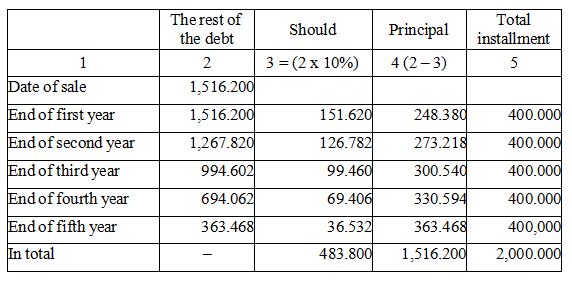

On the example of the sale of goods on credit, the calculation of the amount of interest recognized as interest income at the time of payment will be shown (Milanović, 2023).

Example:

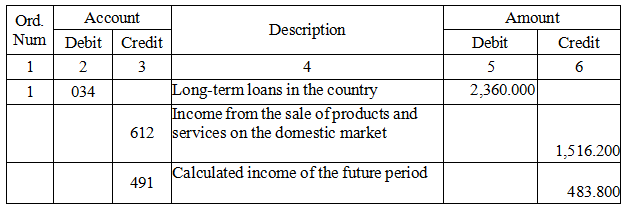

The legal entity sold the equipment at a price of 2,000,000 dinars, with payment in installments without the agreed interest. If the agreed payment upon delivery of the equipment, the buyer would have paid 2,000,000 dinars all at once. This would correspond to the fair value of the equipment (Janković & Golubović, 2024). But, since the buyer pays for the equipment in installments over a period of, for example, five years, it is likely that the fair value of the equipment will be less than the agreed amount due to changes in the value of money over time. In order to calculate this difference, which, in fact, represents the interest that is recognized in income, during the collection of the contracted price of the equipment, it is assumed that the prevailing (most common) interest rate at which the customer could secure a loan for the purchase of the equipment would be 10% per annum .

For five equal annual payments, if the first installment is paid at the end of the first year, the total interest will amount to 483,800 dinars, and the fair value of the equipment fee will be 1,516,200 dinars (2,000,000 – 483,800). Interest per year is calculated as shown in the table:

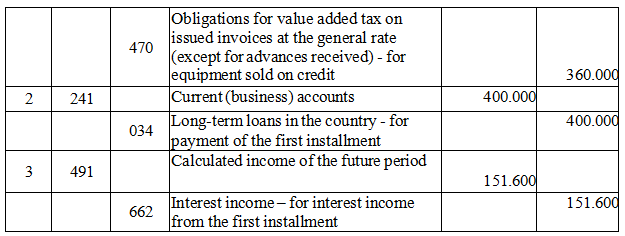

According to this standard, the legal entity-seller should record the transaction from this example as follows:

Fees from royalties charged for leased assets (software, patents, etc.) are realized in accordance with the contract. Revenue recognition is possible: 1) if the contract is concluded, 2) if the asset is transferred, 3) if a fixed fee is determined or the fee is determinable, 4) if collection is probable (paragraph 33).

The right of a shareholder to receive a dividend on the capital of another legal entity arises from the decision of the authority responsible for approving financial statements (the shareholders' meeting) to pay dividends to shareholders. When such a decision is announced, there are conditions for recognizing income based on dividends. If after the end of the period, due to certain circumstances, it becomes known that the payment of the dividend will be absent, the previously recognized income (as in the case of the sale of goods and the provision of services), through the correction of the claim for the dividend, is recognized in the expenses of the period (Milenković et al., 2023).

Conclusion

In order to properly apply the regulations and standards that regulate the recognition and accounting measurement of income, the legal entity should disclose: the adopted accounting policies for the recognition of income, including the adopted method of determining the degree of service completion; the amount of each significant category of recognized income based on: sales of goods, services performed, interest, royalties and dividends (within the report; if necessary, also in the notes); the amount of income generated by the exchange within each category of income.

Any potential gain or loss is disclosed in accordance with IAS 37. These gains or losses can arise most often based on the costs of guarantees, claims, but also other events.

Real estate can be sold with a certain degree of continued involvement of the seller, and the risks and benefits are not transferred. Such examples are contracts on sale and repurchase, according to which the buyer is allowed to enter the possession for a certain period of time or guarantees the return of the deposit during a certain period. In these cases, it is assessed what kind of transaction it is and how it will be accounted for - whether as a sale, financing, lease or some other arrangement for profit sharing. If revenue is generated, the contractual arrangement may require deferred revenue recognition. Assembly services are recognized in revenue according to the degree of completion of the assembly. If the value of the assembly is insignificant (activating a television receiver, assembly of furniture, etc.), it is recognized as income when the goods are sold. Service costs included in the price of the product. If servicing costs can be identified (after-sales support, product improvement when selling software), that part of the price is earned subsequently during the period in which the services are performed. That amount of deferred revenue should cover servicing costs and reasonable profit.

References

2.ASB - Accounting Standards Board. (2003). Amendment to FRS 5 ‘reporting the substance of transactions’. Revenue recognition (Application Note G).

3.Astami, E.W., Rusmin, R., Hartadi, B. & Evans, K. (2017). The role of audit quality and culture influence on earnings management in companies with excessive free cash flow: Evidence from the Asia-Pacific region. International Journal of Accounting & Information Management, 25(1), 21–42. https://doi.org/10.1108/IJAIM-05-2016-0059

4.Camfferman, K. & Zeff, S.A. (2015). Aiming for Global Accounting Standards: The International Accounting Standards Board, 2011–2011. Oxford: OUP.

5.Christensen, H.B. & Nikolaev, V.V., (2017). Contracting on GAAP changes: large sample evidence. Journal of Accounting Research, 55 (5), 1021–1050.

6.Dašić, B., Župljanić, M. & Pušonja, B. (2023). Uloga regulatornog okvira na prilive stranih direktnih investicija. Akcionarstvo, 29(1), 95-112.

7.Donatella, P., Haraldsson, M., & Tagesson, T. (2019). Do audit firm and audit costs/fees influence earnings management in Swedish municipalities? International Review of Administrative Sciences, 85(4), 673–691. https://doi.org/10.1177/0020852317748730

8.Dutta, T.K., Raju, V. & Kassim, R.N.M. (2020). Green accounting in achieving higher corporate profitability and sustainability in ready made garment industry in Bangladesh: A conceptual analysis. International Journal of Innovation, Creativity and Change, 5(4), 181-192.

9.Ernstberger, J., Link, B., Stich, M. & Vogler, O. (2017). The real effects of mandatory quarterly reporting. The Accounting Review, 92 (5), 33–60.

10.Hindasah, L. & Nuryakin, N. (2020). The relationship between organizational capability, organizational learning and financial performance. Journal of Asian Finance, Economics and Business, 7(8), 625-633. https://doi.org/10.13106/jafeb.2020. vol7.no8.625

11.IASB - International Accounting Standards Board. (2018). Conceptual framework for financial reporting

12.Janković, G. & Golubović, M. (2024). Analiza uticaja koncepta cirkularne ekonomije na privredni razvoj. Održivi razvoj, 6(1), 7-

31. https://doi.org/10.5937/OdrRaz2401007J

13.Milanović, N. (2023). Menadžment finansijske održivosti neprofitnih organizacija. Održivi razvoj, 5(1), 7-17.

https://doi.org/10.5937/OdrRaz2301007M

14.Milenković, N., Radosavljević, M. & Vladisavljević, V. (2023). Korišćenje aplikacija sa otvorenom licencom u razvoju programa poslovnog preduzeća. Održivi razvoj, 5(2), 35-

49. https://doi.org/10.5937/OdrRaz2302035M

15.Plumlee, M., Brown, D., Hayes, R. M. & Marshall, R. S. (2015). Voluntary environmental disclosure quality and firm value: Further evidence. Journal of Accounting and Public Policy, 34(4), 336-361. https://doi.org/10.1016/j. jaccpubpol.2015.04.004

16.Savić, A, Mihajlović, M.,. & Ristić, D. (2024). Menadžerski aspekti egzistiranja preduzeća na savremenom tržištu, Ekonomski izazovi, 13 (26), 15-24. https://doi.org/10.5937/ EkoIzazov2426015S

17.Savić, A. & Bonić, Lj. (2022). Analysis of the impact of reporting on environmental performance idicator on the profitability of European companies, Facta Universitatis – Economics and Organization, 19 (3), 167-

182. https://doi.org/10.22190/FUEO220529013S

18.Savić, A., Mihajlović, M. & Božović, I. (2023). Macroeconomic aspects of comprehensive costs of assets as a prerequisite for equipping the defense system with weapons and military equipment, Vojnotehnički glasnik, 71 (3), 797-815. https://doi.org/10.5937/vojtehg71-44145

19.Stankov, B. & Roganović, M. (2022). Pružanje podrške i podsticanje razvoja malih i srednjih preduzeća u Evropskoj uniji. Akcionarstvo, 28(1), 21-44.

20.Sugiyanto, S. & Sumantri, I.I. (2019). Peran Audit Internal Dan Sistem Pengendalian Internal Atas Pengajuan Kredit Tanpa Agunan Pada Perusahaan Perbankkan Di Indonesia. Jurnal Akuntansi, 13(2), 196-224.

Svabova, L., Valaskova, K., Durana, P. & Kliestik, T. (2020). Dependency analysis between various profit measures and corporate total assets for Visegrad groups business entities. Organizacija, 53(1), 80–90. https://doi.org/10.2478/org-2020-0006

22.Zalata, A. M., Tauringana, V. & Tingbani, I. (2018). Audit committee financial expertise, gender, and earnings management: Does gender of the financial expert matter? International Review of Financial Analysis, 55, 170–

183. https://doi.org/10.1016/j.irfa.2017.11.002

23.Zeff, S.A. (2018). An Introduction to Corporate Accounting Standards: detecting Paton’s and Littleton’s influences. Accounting Historians Journal, 45 (1), 45–67.

Published in

Vol. 10 No. 3 (2024)

Keywords

🛡️ Licence and usage rights

This work is published under the Creative Commons Attribution 4.0 International (CC BY 4.0).

Authors retain copyright over their work.

Use, distribution, and adaptation of the work, including commercial use, is permitted with clear attribution to the original author and source.

Interested in Similar Research?

Browse All Articles and Journals