UTICAJ KORPORATIVNOG UPRAVLJANJA NA EKONOMSKU BEZBEDNOST

Apstrakt

Korporativno upravljanje predstavlja skup mehanizama, pravila i procesa putem kojih se usmerava i kontroliše poslovanje preduzeća, sa ciljem obezbeđivanja efikasnosti, odgovornosti i transparentnosti. Istovremeno, ekonomska bezbednost preduzeća podrazumeva stabilnost, otpornost i sposobnost organizacije da zaštiti svoje resurse i poslovne interese od unutrašnjih i spoljašnjih rizika. Rad ispituje povezanost između korporativnog upravljanja i ekonomske bezbednosti, ukazujući na to da dosledna primena principa upravljanja doprinosi smanjenju rizika, jačanju poverenja investitora, efikasnijem korišćenju resursa i dugoročnoj održivosti poslovanja. Posebna pažnja posvećena je transparentnosti, odgovornosti menadžmenta, kao i ulozi internih kontrola i sistema korporativne bezbednosti u očuvanju ekonomske stabilnosti preduzeća. Analizom relevantne literature i prakse, rad ukazuje na značaj integrisanog pristupa korporativnom upravljanju i upravljanju bezbednošću kao ključnih faktora konkurentnosti i opstanka preduzeća u savremenim poslovnim uslovima.

Članak

Introduction

The modern business environment is characterized by continuous and dynamic changes, high competition and increasingly complex forms of risks to which companies are exposed. In such a complex context, the issue of preserving the sustainability of business and the economic security of the company becomes one of the key issues facing management and the corporate governance system(Trifunović et al., 2023). Corporate governance is defined as a set of structures, processes and decision-making mechanisms that enable a company to operate efficiently, responsibly and in accordance with laws and ethical standards, with particular importance being the protection of the interests of various stakeholders – owners, employees, investors, as well as the wider social community (Rajnović & Bukvić, 2017). Through adequate corporate governance, a company can develop mechanisms for identifying and managing risks, optimizing business processes and increasing the trust of relevant stakeholders.

Economic security, on the other hand, implies the ability of a company to maintain stability and continuity of business, as well as financial resilience to various internal and external threats that can disrupt business. According to Trivan et al. (2024), economic security includes several key elements: the protection of material and intangible resources, the prevention of financial and operational losses, the preservation of business continuity, and the ability of the organization to respond and adapt to crisis situations. This clearly shows that economic security cannot be viewed in isolation from corporate governance, because the quality and efficiency of management mechanisms directly affect the organization's ability to recognize, mitigate and overcome possible economic and security challenges.

The connection between corporate governance and economic security is particularly important in the modern conditions of globalization, digitalization and increasingly frequent economic and security crises(Ristanović et al., 2024). Business transparency, management accountability, effective internal controls, as well as a clearly defined security strategy, represent the fundamental pillars of maintaining competitiveness and long-term sustainability of the company(Trifunović et al., 2024). In this way, the company not only protects its resources and financial stability, but also strengthens the trust of investors and other key participants in the business ecosystem.

The aim of this paper is to thoroughly investigate and analyze the impact of corporate governance on the economic security of the company(Škrbić et al., 2023), with special attention to the theoretical foundations, as well as the practical implications of the application of modern management models and security management. The analysis aims to highlight the importance of an integrated approach, in which effective corporate governance becomes a key factor in preserving the stability, resilience and long-term sustainability of a company's business.

Corporate governance – theoretical framework

Corporate governance is one of the key and central concepts of modern economics and management, as it directly deals with the way in which the mutual relations between capital owners, management and other stakeholders within a company are organized and regulated. According to the OECD definition, corporate governance means a set of structures, procedures and processes that direct and supervise the operations of a company, with the ultimate goal of ensuring long-term sustainability, accountability and transparent functioning (Zattoni & Pugliese, 2021). In other words, it is not just a formal framework or administrative procedure, but a system of values and rules that define how decisions are made, how their implementation is monitored and how the interests of all stakeholders involved in the company's operations are protected.

The professional literature particularly emphasizes that the development of the concept of corporate governance was conditioned by multiple socio-economic and market processes. Among the most important are the processes of privatization, globalization, and increasing integration of capital markets, as well as the emergence of numerous corporate scandals in the late 20th and early 21st centuries, which clearly indicated the necessity of strengthening the regulatory framework, internal controls, and oversight mechanisms in companies (Jin et al., 2021; Majstorović & Obrić, 2023). These scandals have shown that without adequate governance and ethical oversight, companies can find themselves in situations that threaten not only the interests of investors, but also broader economic stability.

Authors who deal with this topic emphasize that the basic principles of corporate governance are as follows (Khanh et al., 2020):

- Shareholder rights and equal treatment – protecting the interests of all shareholders, both majority and minority, by ensuring that company decisions are made transparently and in accordance with the law;

- The role of stakeholders – recognizing and taking into account the interests of employees, consumers, suppliers, local communities and other stakeholders who are directly or indirectly related to the company's operations;

- Transparency and disclosure of information – the obligation to timely, accurately and completely inform investors, regulatory bodies and the general public about the financial and business condition of the company;

- Responsibility of management and supervisory bodies – clearly defining the responsibilities of management and supervisory bodies, as well as establishing effective mechanisms for controlling and evaluating decisions.

These principles form the basis for ethical, transparent and sustainable business, because through them companies can build trust with investors, improve their

reputation and create solid assumptions for stable economic development. Rajnović and Bukvić (2017) particularly emphasize that quality corporate governance contributes to reducing the so-called agency problem, i.e. the separation of ownership and management. This is achieved through the establishment of a control system, management reward mechanisms and protection of shareholder interests, which in the long term increases the efficiency and resilience of companies to market risks.

In addition to the theoretical foundations, there are different models and approaches to corporate governance. The most famous among them are:

- The Anglo-Saxon model, which puts shareholders and the capital market in the foreground and is characterized by high flexibility in making business decisions;

- The German model, based on a dual system of management and supervision, where there is a clear division between the executive and supervisory functions;

- The Japanese model, which includes interest groups (stakeholders) to a greater extent and emphasizes the interdependence of companies through keiretsu structures and long-term partnerships.

The choice and application of a specific model depend on the institutional and legal framework of each country, but also on the specifics of the market, business culture and the level of development of corporate institutions.

In the Republic of Serbia, the development of corporate governance has become particularly important after the privatization and restructuring of enterprises. The country has made intensive efforts to improve the regulatory framework and practice, although practice shows that many enterprises still do not fully recognize the importance and complexity of this area. This indicates a continuous need for further harmonization with international standards and strengthening the capacities of management and supervisory bodies (Triapathi, 2019).

In this context, corporate governance cannot be viewed solely as a formal framework or legal requirement, but as a strategic instrument that enables long-term sustainability, stability and security of business. Its implementation affects not only the financial performance of the enterprise, but also the ability of the enterprise to respond to market challenges, global economic changes and crisis situations. In the next chapter of the paper, attention is paid to the concept and importance of the economic security of the enterprise, because it is in this framework that corporate governance shows its real impact and functional importance.

Economic security of a company – definition

Economic security of a company represents the ability of an organization to protect its key resources, maintain business stability and ensure long-term sustainability even in the presence of various internal and external risks. In the broadest sense, this concept includes the protection of financial assets, material goods, human resources and information, but also the ability of a company to respond effectively to changes and challenges brought about by market fluctuations, economic crises, unfair competition or criminal activities (Aguilera & Jackson, 2003). Therefore, economic security can be seen as an integral concept that connects different aspects of business and ensures the resilience and long-term sustainability of the organization.

The concept of economic security can be broken down into several interrelated dimensions that together form a comprehensive system of protection and risk management in a company (Enache & Hussainey, 2019):

- Financial security – includes balance sheet stability, preservation of liquidity and the ability of a company to service all its obligations on time, thereby reducing the risk of insolvency;

- Operational security – refers to business continuity, resilience to supply chain disruptions, technical and technological accidents and unplanned interruptions in production or service provision;

- Information and cyber security – focuses on protecting confidential and business data from misuse, unauthorized access and cyber threats, which can seriously jeopardize a company’s business and reputation;

- Legal and regulatory security – involves compliance with laws, regulations and regulatory standards, thereby minimizing the risk of legal sanctions, fines or loss of a license to operate;

- Reputational security – refers to preserving a company’s reputation and the trust of key stakeholders, including shareholders, employees, customers and the general public, as reputation directly affects business sustainability and competitive advantage.

Corporate security, as an integrated function that combines all these dimensions, plays a key role in harmonizing security and business processes, thereby achieving greater resilience and efficiency in business. According to the Handbook for Corporate Security Managers, economic security is considered an integral part of the company's strategy, as it enables stable development, prevention of potential losses and protection of the interests of all relevant stakeholders inside and outside the organization (Clarke, 2020; Milenković, 2023).

It is important to emphasize that economic security is not a static or one-time category, but rather a continuous process that requires constant monitoring, periodic assessment and prompt adjustment of strategies and operational procedures (Ou- Yang, 2008). The modern business environment is characterized by numerous and increasingly complex challenges - from global economic and financial crises, political instability and changes in international markets, to high-tech crime, cyber threats, climate change and natural disasters. In this context, economic security becomes a strategic priority for management, as it enables the long-term preservation of competitive advantage, protection of business resources and stable survival of the company in the market.

Starting from this comprehensive definition of economic security, the next chapter analyzes in more detail the impact of corporate governance on the economic security of enterprises. Special focus will be placed on governance mechanisms, their importance in reducing risk, and the role they play in strengthening the resilience and stability of business processes.

The impact of corporate governance on the economic security of a company

Corporate governance has a direct and significant impact on the economic security of enterprises, which is achieved through improving financial stability, increasing the level of transparency in business operations and building trust among various stakeholders, including shareholders, investors, employees and the wider community. Establishing an effective governance system allows enterprises to reduce the risk of corruption, misuse of resources and managerial errors, while at the same time increasing their resilience to various crises and unforeseen situations (Solomon, 2021). In other words, corporate governance is not just a formal decision- making structure, but a key mechanism for preserving and strengthening the economic security of enterprises in a dynamic business environment.

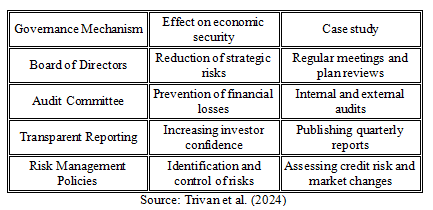

According to Trivan et al. (2024), the key mechanisms through which corporate governance contributes to economic security are:

- Transparency and Disclosure – One of the fundamental principles of corporate governance is timely, accurate and comprehensive information to shareholders, investors and other stakeholders. Transparency in business reduces the risk of manipulation, hidden business arrangements and potential conflicts of interest, which directly increases market confidence and contributes to a more stable business environment. The OECD principles emphasize that the publication of financial statements, key business decisions and risk assessments creates a safer investment environment, as it allows investors and other participants to make informed decisions.

- Management accountability – Effective corporate governance includes clearly defined management obligations and responsibilities, where managers are expected to make decisions in the best interests of the company, and not for personal gain. This principle reduces the agency problem that arises from the separation of ownership and management, which is often a source of abuse and corporate scandals (Mallin, 2019). Responsible management contributes to the economic health of a company by strengthening its resilience to business challenges and risks, including financial, operational and reputational aspects.

- Effective internal controls and audits – Internal controls and audit systems are a key element in protecting a company and its resources. They enable timely detection of irregularities, prevention of losses and reduction of opportunities for corrupt practices. According to the Handbook for Corporate Security Managers (Tricker, 2019), internal controls and investigations are an integral part of a company's protection system, as they ensure compliance with legal and ethical norms. The implementation of a key performance indicator (KPI) system additionally enables management to respond in a timely manner to deviations from planned goals(Janković & Golubović, 2025), which contributes to stability and long-term preservation of economic security.

Table 1. The impact of corporate governance mechanisms on economic security

- Risk management and business continuity - Effective corporate governance also includes the introduction of a risk management system that enables the identification, assessment and minimization of threats to the financial and operational stability of the company (Syamsudin et al., 2020). This approach enables business continuity and resilience to crisis situations, which can be caused by market fluctuations, cyber threats, natural disasters or regulatory changes. Companies that integrate risk management into their corporate structure achieve a higher level of economic security and preparedness for unforeseen events.

- Reputational security and market trust - A company's reputation has a direct impact on its economic security. Companies that implement developed corporate governance mechanisms enjoy a higher degree of trust from investors, partners and consumers, which makes them more attractive for obtaining capital and expanding their business. Conversely, poor governance can lead to scandals, a decline in market value and a decrease in competitiveness.

- Empirical indicators of the relationship between governance and security - Research shows that companies with a high level of corporate governance development record significantly better financial results, greater reputation in the market and greater resilience to crisis situations (Savić et al., 2024; Paspalj et al., 2024). These empirical data confirm theoretical assumptions about the key role of corporate governance in preserving economic security.

- Corporate social responsibility (CSR) and economic security - CSR is an important aspect of modern corporate governance and has a significant impact on the economic security of companies. Companies that operate in accordance with the principles of social responsibility invest in environmental protection, ethical treatment of employees, transparent relations with consumers and active contribution to local communities. Rajnović and Bukvić (2017) point out that CSR becomes a strategic instrument for preserving reputation and strengthening trust in the market, which directly contributes to the economic health of the company. Responsible company behavior reduces the risks of regulatory sanctions, negative publicity or consumer boycotts, while at the same time increasing attractiveness for investors and business partners. Trivan et al. (2024) further emphasize that CSR also has a security dimension – companies that invest in the well-being of their employees, local communities and environmental sustainability develop a higher level of resilience to crisis situations. For example, a company that implements developed environmental protection policies or social care for employees shows a greater ability to quickly recover and continue operating in crisis circumstances. For this reason, CSR can also be seen as a preventive mechanism within corporate governance, which reduces business risks and strengthens long-term resilience. Integrating social responsibility into business strategies does not represent an additional cost, but rather an investment in the long-term survival and economic security of the company.

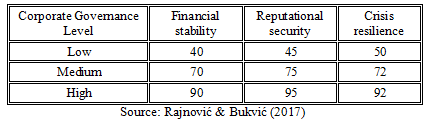

The table below shows an example of the relationship between the level of development of corporate governance and indicators of economic security:

Table 2: Relationship between the level of development of corporate governance and indicators of economic security

The analysis of the relationship between the level of development of corporate governance and the level of economic security of the enterprise shows a clear and direct correlation – the higher and better implemented the standards of governance in the enterprise, the higher the level of stability, security and resilience to crisis situations. For this purpose, the table presents three different models of corporate governance: low, medium and high level (Oliver, 2005).

Enterprises with a low level of governance are characterized by numerous shortcomings: a low level of transparency in business operations, insufficient responsibility of management for making strategic and operational decisions, as well as a complete lack of adequate internal controls. As a result of this approach, the financial stability of these enterprises is relatively low and amounts to 40 out of a possible 100 points, while reputation security is threatened and rated at 45/100, and resilience to crisis situations is limited to 50/100. In practice, such companies often face problems of losing investor confidence, difficult access to capital, as well as the risk of scandals and business failures that can threaten the very survival of the company.

In companies that apply a medium level of corporate governance, where basic mechanisms of transparency, accountability and control are implemented, significant progress is observed in all key aspects of economic security. The financial stability of these companies increases to 70/100, reputational security to 75/100, and resilience to crisis situations to 72/100. Such companies function relatively stably in standard market conditions, but still remain subject to risks in the event of global economic disruptions, sudden corporate scandals or cyber incidents, which can seriously threaten their business continuity.

The highest level of corporate governance directly contributes to the highest level of economic security. Companies with a developed and well-structured management system, in which the principles of accountability, transparency and effective internal control are consistently applied, achieve significantly better results: financial stability is at a high level of 90/100, reputation security is 95/100, and resilience to crisis situations reaches 92/100. In addition, such companies not only attract investors and strategic partners, but also strengthen their long-term competitiveness thanks to a high level of trust, data confidentiality and well-developed business continuity plans.

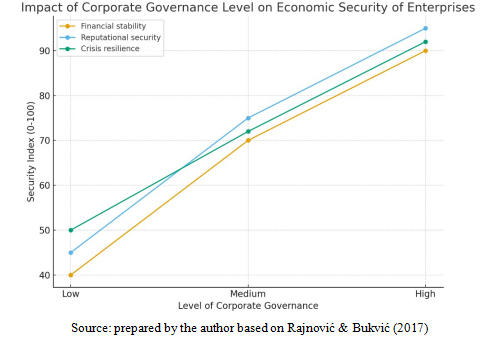

The attached graph clearly shows a positive trend - the higher the level of corporate governance, the higher the degree of economic security in all dimensions: financial stability, reputation and resilience to crisis situations. The graph illustrates a linear relationship between the level of governance and all indicators of economic security, which confirms that investing in management mechanisms directly contributes to the protection and improvement of business performance.

It is important to note that in modern business conditions, all three dimensions - financial stability, reputation security and resilience to crisis situations - are interconnected and act synergistically. Financial stability allows a company to make investments in security and development capacities, while reputational security strengthens relationships with the market, partners and the wider social environment. At the same time, resilience to crisis situations ensures business continuity and survival in unforeseen and turbulent circumstances.

Such an analysis fully confirms the conclusions of numerous researchers (Popović et al., 2016), according to which economic security cannot be viewed separately from the quality of management processes. In other words, corporate governance and economic security constitute two inextricably linked components of the same system – effective management creates a stable basis for the protection of resources, while high economic security enables the long-term implementation of strategic business goals and the development of the organization.

Chart 1: Relationship between the level of development of corporate governance and indicators of economic security

These results clearly indicate that the implementation of modern corporate governance principles not only leads to improved competitiveness of the company, but also ensures its long-term sustainability and business stability. Therefore, the implementation of an integrated approach that connects corporate governance with security management becomes a key prerequisite for adequate protection of the interests of all relevant stakeholders – from owners and employees to the wider social community. This approach allows strategic decisions to be made in accordance with the principles of transparency, accountability and sustainability, which further contributes to the creation of a stable and safe business environment.

Practical examples

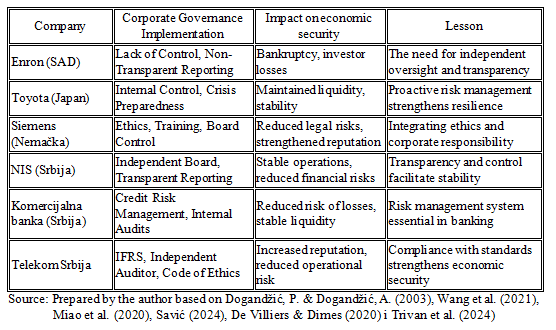

The practical application of corporate governance principles plays an extremely important role in preserving the economic security of enterprises. Although theoretical frameworks and models emphasize key principles such as accountability, transparency and effective control, the real effects of the application of these mechanisms can best be seen through concrete examples from practice, both international and domestic(Vladisavljević et al., 2023). In this chapter, attention is focused on a detailed analysis of successful and unsuccessful cases, with special attention paid to the correlation between the quality of corporate governance and business stability, indicating how consistent application of the principles can contribute to preserving the financial and operational security of enterprises.

International examples

a) Enron – a study of failure

The Enron scandal is a classic and illustrative example of how the absence of effective corporate governance can be disastrous for the survival and stability of a company. In this case, the company's board of directors failed to establish adequate mechanisms for supervising the work of management, which resulted in serious control failures. In addition, the company's financial statements were non-transparent and susceptible to manipulation, primarily through the use of off-balance sheet structures that concealed the true state of liabilities and risks. As a direct consequence of such practices, investors suffered huge financial losses, and the general public and the capital market experienced a serious blow to their confidence in the integrity and reliability of financial statements (Dogandžić, P. & Dogandžić, A., 2003; Gojkov, 2024). This case clearly indicates the key role of corporate governance in preserving financial stability and protecting the interests of all stakeholders.

b) Toyota – maintaining stability in crises

Toyota Motor Corporation is an example of a company that managed to mitigate risks during the global financial crisis of 2008–2009 through the implementation of a high level of corporate governance. In order to maintain business stability, Toyota implemented a comprehensive internal control system that enabled the monitoring and management of key business processes. In addition, the company established a clear hierarchy of responsibilities, which defined responsibility at all levels of management, while at the same time facilitating quick and efficient decisions in crisis situations. A proactive approach to crisis management allowed the company to anticipate potential problems and take preventive measures, which resulted in preserving liquidity and business stability, even during a period of global sales decline (Wang et al., 2021). This practice shows that effective corporate governance can significantly contribute to a company's resilience to external shocks and financial instability.

a) Siemens – integrating ethics and corporate responsibility

After Siemens AG was involved in a corruption scandal in the early 2000s, the company implemented a comprehensive corporate governance program. This program included the introduction of a code of ethics, mandatory training for all employees, and increased oversight by the board of directors. As a result of these measures, Siemens was able to improve its reputation, reduce legal risks, and improve the company's economic performance (Miao et al., 2020).

Domestic examples

a) NIS a.d. Novi Sad

The Oil Industry of Serbia (NIS), as part of the privatization and comprehensive restructuring process, adopted modern corporate governance standards that significantly improved the way the company operates. The Board of Directors, composed not only of internal members but also of independent experts, combined with an efficiently implemented internal control system, played a key role in achieving more stable and predictable financial operations. In addition, the company introduced the practice of transparent publication of quarterly reports, thus providing investors with timely and accurate insight into business results. This approach directly contributed to reducing the risk of unexpected financial losses, strengthening market and investor confidence in NIS (Savić, 2024).

b) Komercijalna banka a.d. Beograd

In the financial sector, Komercijalna banka is a clear example of how good corporate governance can directly contribute to strengthening the economic security of a company. The implementation of a comprehensive risk management system, together with regular and detailed reviews of the credit portfolio, as well as constant supervision of the bank's liquidity, has enabled a significant reduction in potential credit and market risks. This approach demonstrates how effective and responsible governance is crucial for maintaining stability, especially in the banking sector, where the economic security and resilience of an institution depend directly on the ability of management to recognize early signs of risk and take appropriate measures to mitigate them (De Villiers & Dimes, 2020; Dašić et al., 2023).

c) Telekom Srbija

Telekom Srbija has implemented corporate standards that are fully aligned with international guidelines, with particular emphasis on reporting in accordance with International Financial Reporting Standards (IFRS) and the engagement of an independent auditor. This alignment with international norms has enabled the company to improve the level of transparency in its operations, while the introduction and implementation of an employee code of ethics has further contributed to strengthening the company's reputation. As a result of these measures, the risk of possible financial and operational losses has been significantly reduced, ensuring more stable and reliable operations for the company (Trivan et al., 2024).

Table 3: Comparative overview of domestic and international examples

Practical examples from real business environments clearly illustrate the strong connection between the quality of corporate governance and the level of economic security of a company. When a company does not have adequate and effective supervision, as well as a high degree of transparency in its business processes, it becomes exposed to significant financial losses and potential damage to its reputation, which can seriously threaten its long-term stability and sustainability(Milanović, 2023). On the other hand, the implementation of modern corporate governance standards, including well-defined internal procedures and control mechanisms, significantly reduces operational and strategic risks, strengthens the organization's resilience to crisis situations and increases the trust of both investors and the general public.

Among the key factors contributing to this positive connection are(Bučalina Matić et al., 2024):

- Transparent and accurate financial reporting.

- Active and independent role of boards of directors.

- Effective risk management and crisis preparedness.

- Integration of ethics and social responsibility into business.

These practical examples strongly confirm that corporate governance is not just a regulatory obligation or formality, but functions as a strategic instrument for preserving the economic security and stability of a company, enabling it to maintain competitiveness and long-term development.

Conclusion

The analysis of the impact of corporate governance on the economic security of enterprises clearly shows that high-quality, professional and efficient management is one of the key factors that directly contribute to preserving the stability of business operations and long-term sustainability of enterprises. The application of corporate governance principles – including transparency in business operations, a high degree of management responsibility, professionalism in making strategic decisions, as well as active and continuous monitoring and management of risks – allows enterprises to significantly reduce potential financial losses, operational disruptions and risks that can damage the company's reputation in the market.

Various corporate governance mechanisms, which are applied in practice, include the establishment of clearly defined control procedures, detailed strategic planning, an integrated system of internal and external audits, as well as the implementation of policies related to corporate social responsibility. These mechanisms jointly contribute to creating trust among key business stakeholders – including investors, employees, customers, suppliers and the general public interested in the business results of the enterprise. In this sense, transparency and accountability should not be viewed only as regulatory obligations that a company must fulfill, but also as fundamental factors that ensure the stability and resilience of a company to economic fluctuations, market turbulence and unforeseen business shocks.

Practical examples from existing literature and relevant documents indicate that companies that consistently and systematically apply the principles of corporate governance achieve a higher level of economic security. Such companies manage to reduce the risk of sudden financial losses, crisis situations and potential reputational damage, which directly increases their ability for sustainable growth and competitiveness in the market. At the same time, investing in corporate social responsibility initiatives further strengthens the company's image, increases the trust of the public and business partners, and creates a long-term sustainable advantage over competitors.

In conclusion, it can be clearly stated that corporate governance is an indispensable element of modern business strategies. Its consistent application has a direct and measured impact on the economic security of a company, reducing business risks and contributing to stable and sustainable development. Future research in this area should be focused on quantitatively measuring the effects of corporate governance on corporate resilience, as well as evaluating new approaches and methods in risk prevention and management, with the aim of further improving strategies that enable long-term stability and sustainability of business.

Reference

2.Bučalina Matić, A., Trifunović, D., & Blanuša, A. (2024). Značaj adekvatnog upravljanja otpadom i reciklaže u zaštiti životne sredine. Društveni horizonti, 3(7), 71–90.

3.Clarke, T. (2020). International corporate governance: A comparative approach

(3rd ed.). Routledge.

4.de Villiers, C. & Dimes, R. (2020). Determinants, mechanisms and consequences of corporate governance reporting: a research framework. J Manag Gov, 25, 7–26.

5.Dašić, B., Župljanić, M. & Pušonja, B. (2023). Uloga regulatornog okvira na prilive stranih direktnih investicija. Akcionarstvo, 29(1), 95-112

6.Dogandžić, P. & Dogandžić, A. (2021). Menadžerske kompetencije i modeli za rešavanje agencijskog problema. BizInfo – Časopis iz oblasti ekonomije, menadžmenta i informatike (Blace), 12 (2).

7.Enache, L. & Hussainey, K. (2019). The substitutive relation between voluntary disclosure and corporate governance in their effects on firm performance. Review of Quantitative Finance and Accounting, 54(2), 413-445.

8.Gojkov, D. (2024). Karakteristike objekata prava i državine. Revija prava javnog sektora, 4(1), 23-34

9.Janković, G., & Golubović, M. (2025). Cirkularna ekonomija kao osnova održivog razvoja danasnjice. Održivi razvoj, 7(1), 31-

62. https://doi.org/10.5937/OdrRaz2501031J

10.Jin, S., Gao, Y. & Xiao, S. S. (2021). Corporate governance structure and performance in the tourism industry in the COVID-19 pandemic: An empirical study of Chinese listed companies in China. Sustainability, 13(21), 11722. https://doi.org/10.3390/su132111722

11.Khanh, V., Hung, D., Van, V. & Huyen, H. (2020). A study on the effect of corporate governance and capital structure on firm value in Vietnam. Accounting, 6(3), 221-230.

12.Majstorović, A. & Obrić B. (2023). Principi za poboljšanje dosadašnjeg stanja interne budžetske revizije. Finansijski savetnik, 28(1), 51-68

13.Mallin, C. A. (2019). Corporate governance (6th ed.). Oxford University Press.

14.Miao, C., Duan, M., Sun, X. & Wu, X. (2020). Safety management efficiency of China’s coal enterprises and its influencing factors-Based on the DEA-Tobit two-stage model. Process Safety and Environmental Protection, 140: 79-85. https://doi.org/10.1016/j.psep.2020.04.020

15.Milanović, N. (2023). Menadžment finansijske održivosti neprofitnih organizacija. Održivi razvoj, 5(1), 7-

17. https://doi.org/10.5937/OdrRaz2301007M

16.Milenković, N. (2023). Mogućnosti koriscenja aplikacija sa otvorenom licencom u razvoju programa. ITB-informatika, tehnika, biznis, 1(1), 33-48

17.Oliver, B. (2005). The impact of management confdence on capital structure. Corp Finan Capit Struct Payout Policies eJ. https://doi.org/10.2139/ssrn.791924

18.Ou-Yang, H. (2008). An empirical analysis of the effect components of the corporate governance index on firm value: evidence from Taiwan’s financial industry. The Business Review, Cambridge, 10(1), 119-128.

19.Paspalj, M., Paspalj, D., & Milojević, I. (2024). Održivost savremenih ekonomskih sistema. Održivi razvoj, 6(1), 33-

45. https://doi.org/10.5937/OdrRaz2401033P

20.Popović, S., Tošković, J., Grublješić, Z., Duranović, D. & Petrović, V. (2016). Importance of planning internal audit transition countries observed over public sector of the economy in Serbia, Annals – Economy Series. Constantin Brancusi University, Faculty of Economics, 2, 153–159.

21.Rajnović, Lj. & Bukvić, R. (2017). Korporativno upravljanje kao deo poslovne strategije kompanija. Institut za ekonomiku poljoprivrede, Beograd.

22.RathaKrishnan, L. & Santhy, K. (2002). Globalisation, Multinational Corporation and regional development. Management and Labour Studies, 27(3): 191-198. https://doi.org/10.1177/0258042X0202700304

23.Ristanović, V., Bučalina Matić, A., & Lalić, G. (2024). Uloga upravljanja otpadom u cirkularnoj ekonomiji korišćenjem AHP metode. Društveni horizonti, 3(7), 57–69.

24.Savić, A., Ivanova, B. & Rajković A. (2024). Korporacija i savremeno okruzenje, Engineering management 10 (1), 39-47.

https://menadzment.tfbor.bg.ac.rs/english/wp- content/uploads/sites/2/2025/01/10_1_39-47.pdf

25.Savić, A., Mihajlović, M. & Ristić, D. (2024). Menadžerski aspekti egzistiranja preduzeća na savremenom tržištu, Ekonomski izazovi, 13 (26), 15-24.

https://doi.org/10.5937/EkoIzazov2426015S

26.Solomon, J. (2021). Corporate governance and accountability (5th ed.). Wiley.

27.Syamsudin, S., Setyawan, A. & Praswati, A.N. (2020). Corporate governance and firm value: a moderating effect of capital structure. Creativity and Innovation Management, 12(2), 264-277.

28.Škrbić, S., Malešić, S. & Gojkov, D. (2023). Proces budžetskog planiranja.

Revija prava javnog sektora, 3(2),21-36

29.Trifunović, D., Bulut Bogdanović, I., Tankosić, M., Lalić, G., & Nestorović, M. (2023). Research in the use of social networks in business operations. Akcionarstvo, 29(1), 39–63.

30.Trifunović, D., Lalić, G., Deđanski, S., Nestorović, M., & Bevanda, V. (2024). Inovativni modeli i nove tehnologije u funkciji razvoja i kooperacije preduzeća i obrazovanja. Akcionarstvo, 30(1), 177–196.

31.Tricker, B. (2019). Corporate governance: Principles, policies, and practices

(4th ed.). Oxford University Press.

32.Tripathi, A. (2019). Role of Internal Audit in Corporate Governance, International Journal of Scientific Development and Research – IJSDR, 4(6), 259–261.

33.Trivan, D., Jakišić A., Pavlović, D., Radović, Lj., Jovanović, V. & Srdić, S. (2024). Priručnik za menadžere korporativne bezbednosti. SAMKB & CEMS, Beograd.

34.Vladisavljević, V., Mičić, S & Zupur, M. (2023). Analiza kao osnov za donošenje poslovnih odluka. Finansijski savetnik, 28(1), 7-35

35.Wang, J., Shahbaz, M., & Song, M. (2021). Evaluating energy economic security and its influencing factors in China. Energy, 229: 120638. https://doi.org/10.1016/j.energy.2021.120638

36.Zattoni, A. & Pugliese, A. (2021). Corporate governance research in the wake of a systemic crisis: Lessons and opportunities from the COVID–19 pandemic. Journal of Management Studies, 58(5), 1405-1410. https://doi.org/10.1111/joms.12693

Objavljeno u

God. 11 Br. 3 (2025)

Ključne reči

🛡️ Licenca i prava korišćenja

Ovaj rad je objavljen pod Creative Commons Attribution 4.0 International (CC BY 4.0).

Autori zadržavaju autorska prava nad svojim radom.

Dozvoljena je upotreba, distribucija i adaptacija rada, uključujući i u komercijalne svrhe, uz obavezno navođenje originalnog autora i izvora.

Zainteresovani za slična istraživanja?

Pregledaj sve članke i časopise