IMPACT OF THE PANDEMIC COVID - 19 ON THE DIGITALIZATION OF THE BANKING SECTOR OF SERBIA

Abstract

This paper examines the consequences of COVID-19 on the digitalization of the banking sector, in order to identify the challenges and opportunities of the banking sector in Serbia. The research consists of two parts. The first part uses statistical data from regulatory and supervisory bodies, and the second part refers to field research, which is based on a survey. Data processing was created using IBM SPSS Statistics software. Survey questionnaires were collected in the period from January to May 2022. The answers of 174 respondents, bank clients, were accepted for analysis. The questionnaire was compiled using a five-point Likert scale. This sample may not be entirely representative, but in any case it is sufficiently informative, as it is possible to draw a conclusion about the contribution of each variable to the development of digital banking. To analyze the relationship between the metric variable and several independent variables, we use multiple or multiple regression. Our assessments reveal the impact of digital products and services on the development of digital banking. In the research, specific goals should be determined, specifically what percentage of respondents are familiar with digital banking services. Also, further analysis should verify the statement that the proportion of respondents who have a negative attitude towards digital banking is less than 45%. In this research, regression analysis was used, as part of the analysis used to form the digital maturity of clients in Serbia. A two-factor analysis was used to research the preferred types of banking products and services. Data analysis using SPSS version 20 for Windows shows that: There is a positive and significant impact of digital banking products on bank customer satisfaction. Analyzed models for researching client preferences indicate that the bank's managerial approach implies real knowledge and monitoring of the wishes and preferences of its clients, as well as adequate key priorities that managers of the banking industry should provide. The research results show that a digital bank can be a unique answer to all challenges, as well as the most effective tool for retaining and attracting clients.

Article

Introduction

The COVID-19 pandemic, in addition to the health crisis, caused changes in the global economy, but also the way of doing business in all countries. The banking system is most affected by the challenges and risks caused by the pandemic. Financial operations were reshaped. Economic theory and its application in practice show the connection of the financial system with the real economy (Ercegovac, 2002). The path of digital transformation is a path of challenges, so a balance between technology, banking offer and financial needs of clients is necessary. With an adequate research methodology and research tools, it is possible to predict the future behavior of the client and respond with adequate digital solutions. Digital banking is a platform for solving simple financial transactions that will in the future suppress the traditional business relationship between the bank and the client.

The banking system of the Republic of Serbia is facing major changes, and the duration and severity of the consequences of the economic crisis, as well as the speed of recovery, are very difficult to assess. Therefore, bank managers have an arduous task to re-plan scenarios and adapt to the new situation. Analyzing the situation and adequately managing challenges and opportunities is key to the short-term survival and long-term health of the banking industry. Some authors believe that this attitude is crucial for financial organizations (Radić, et al., 2020). In the period of crisis, powerful bank managers are created, who can very successfully respond to all the challenges and take advantage of the opportunities that are offered. Experience shows that leaders need to make decisions today to expect victory in the future. On the basis of wrongly made decisions, crisis prediction models and the behavior of the banking system to various influences from the environment were developed.

In the conditions of the pandemic, the experience of clients is increasingly differentiated, so bank managers suggest changing the current business contents in order to meet the financial needs of their clients and withstand the pressure of growing competition through new models of banking activities. A modern bank must be present on the market in the way that users or clients expect from it. The challenges facing the modern banking industry are largely determined by financial technologies, shadow banking and innovation in finance on the international stage. The patterns by which the banking sector operates were changing even before the outbreak of the pandemic, so we have various existing technological innovations in use. Transformation of banking activities is becoming a necessity, especially digital transformation, as a dominant macrotrend. There is a dominant desire to connect people, despite physical distance, so infinite solutions are an integral part of measures to reduce the rate of contagion, as a safe and secure way of conducting transactions. However, the growth of cashless transactions has caused new challenges for the banking industry in terms of fraud.

pandemic has created the perfect environment for cybercrime in pandemic conditions, among which digitally inexperienced clients and those clients with traditional beliefs who need continuous personalized service are the most affected. According to the Financial Times, it is estimated that more than half of the £43 billion borrowed was lost to fraudulent claims. (Thomas, at al. 2020). A key role for the banking industry is to take a holistic approach to digital experiences. In the conditions of the pandemic, the trend of digital transformation is very current, but solving the problem of the digital gap is becoming more and more dominant. A number of information technologies are in use that can help the process of digital transformation of the banking sector and thus help both managers and clients of the banking sector (integration of artificial intelligence; blockchain technology; internet of things; cloud computing) and other advanced solutions in order to better respond to changes in the way performing business activities.

Objectives of the study

The first and basic goal of the paper is to analyze the structure of the banking sector of the Republic of Serbia and explain its transformation in the short term in the conditions of the pandemic. As a continuation of this goal, an additional analysis is imposed, the examination of clients' attitudes about the banking offer. The main goal of this paper is to investigate the impact of the COVID-19 pandemic on banking operations. The subject of the research is characterized by the topicality and importance of the problem, significant for the banking industry, both from the macroeconomic aspect (effective allocation of resources on the financial market) and the microeconomic aspect (laying off employees) as well as from the psychological aspect (risk and increased stress due to the health and financial crisis). The goal of the research is to determine the consequences of the pandemic on the banking sector of Serbia, as well as to define banking products and services during the pandemic period and to determine the satisfaction of the bank's clients with that offer. Many factors affect customer satisfaction, and some of them are: price, reliability, availability, ease of application, courtesy of service staff, etc. Bearing in mind the key issues that bank managers will face in the future with the dynamics of constant transformation in order to focus on the financial needs of the client, increase profitability, within the limits of risk tolerance, on the one hand, as well as the motivation of clients in choosing a banking offer on the other sides, initiated the choice of topic and focused the subject and research goal of this paper.

The advantage of this research is in the discovery of behavior based on the mutual exchange of management ideas with clients, in order to continuously improve and strengthen these relationships. The behavior of banking clients gravitates from conservatism and aversion to digital sales channels in the period before the pandemic to increasing motivation to use digital banking products during the pandemic. At the same time, a cautious motive of clients due to cybercrime was observed. The obtained data give a clear picture: there are clients who are ready and looking for digital solutions immediately, and bank managers should implement them as soon as possible with increasing protection against the risk of cybercrime, and there is another group of traditional clients who, despite the corona virus, prefer going to the bank. With this research, we make a double contribution to the literature. First, we examine the impact of the pandemic on the digitization of banking operations, through a multi-channel approach, that is, the choice of the client to contact the bank at any time, any time and from any device, digital procedures, electronic management of relations with clients. Second, we propose the desirable characteristics of the banking offer in the process of digital transformation. Examining customer satisfaction is a very important parameter that must be taken into account when forming a banking offer. Based on this research, it is possible to draw a conclusion about the functioning of the banking sector in the future, given that there are various challenges during the pandemic period. Digital transformation of banking operations is no longer seen as a possibility, but as a necessity. What was a matter of choice for most banks in the pre-pandemic period has now become an obligation for all participants in the financial market during the pandemic.

Literature review

It is planned that this research will be carried out in two phases, theoretical research and practical verification. Research on sources of information on the impact of the pandemic on the banking sector indicates a negligible number of determinants on this topic. (about 15,900 results). Searching for sources in English yielded many more sources (48,500,000 results). These mentioned results can be accepted as rough indicators of the openness and topicality of the research topic. The effect of the pandemic on the banking sector includes impact evaluations that are part of a broader evidence-based policy-making program (Gertler, 2011). Several studies have revealed the negative effects of the pandemic, through increased inefficiency, futures price changes, oil price changes, and increasing market volatility (Narayan, 2020; Haldar et al., 2021). We agree with the author's opinion that the COVID-19 pandemic has had a major impact on the global economy. Bearing in mind that in the last year 2021, the world GDP decreased by about 6%, this crisis caused by the pandemic of COVID-19 can be compared to the biggest economic crises of all time, such as the one in 1929, as well as the one caused by the oil shock of the seventies years of the last century (Ramasamy, 2020). In the period from 1970 to 2007, 394 financial crises occurred, among which the most common are 207 currency crises, followed by 124 banking crises and 63 contemporary debt crises (Racickas, et al., 2012). The crisis caused by the COVID-19 pandemic, the increase in systemic risk caused the growth of non-payable loans worldwide (Rizwan, et. al. 2012). The increase in non-performing loans should be viewed in accordance with other unfavorable macroeconomic indicators. The authors (Ari, 2021) observe that during the pandemic, borrowers and companies are increasingly faced with job losses, slowed sales and falling profits. It is a realistic expectation that clients will seek financial assistance, and regulators will encourage banks to help them. The banks themselves have their own plan to protect clients from the corona virus, by recommending working from home, and providing clients with the ability to perform banking activities without physical interaction.

Also, the World Health Organization (WHO, 2020) advised people to use contactless payment as much as possible, because banknotes are considered a potential carrier of the coronavirus. For these reasons, physical banking is becoming less and less attractive, not only for the elderly and burdened population, but also for the younger population. According to Pwc's 2021 research on customer habits, preferences, borrowing, payment, insurance and investing, based on 6,000 respondents, an increase in the number of customers for digital banking services was observed, while 32 percent avoid going to a physical branch. Banks have successfully responded to the challenges in the pandemic period. In the opinion of many authors, digitization leads to a reduction of up to 25% of costs, which directly leads to an increase in income in the segment of short-term and cash lending. The pandemic is boosting digital banking, online banking, telephone banking and call center services. While the coronavirus makes the need for digital banking services more urgent, consumers' growing preference for digitization is nothing new. According to a recent survey by Lightico, 56% of banking consumers reported being diverted from online banking interactions to brick-and-mortar locations. As many as 48% of respondents say they have been asked to print, sign and email documents while banking online (Lighico, 2021). In order to provide digitized banking services to ensure success in the financial market, AtKearney, in his research, suggests that banks should implement electronic database and customer interactions through social networks, with lower costs (AtKearney, 2014). Banks can obtain data on social networks about the opinions of users about new banking products and services, the quality of customer service, and the problems that are present. The US banking industry is in a major digital arms race. For many banks, digital distribution channels for their products and services have become more important than branches and ATMs. Banks in developed countries believe that investments in digital technology bring greater benefits than the satisfaction of their customers. For example, Bank of America receives more deposits from its mobile channel than from branches (Rogers, 2018).

A review of the literature shows that digital transformation has been accelerated by an average of six years (Twilio, 2020). Research from a consulting company shows that bank customers have increased their use of digital banking services by 50% since the start of the pandemic, and 71% of them use digital banking channels weekly (KPMG, 2020). Research conducted in Kosovo (Božović, 2016) indicates that the digital distribution channels of the banking offer are still not represented to the extent they should be, but banks are interested in digitizing their services on a larger scale. The transformation of the banking system should be directed towards the client (Jaubert, 2014). Many useful solutions and recommendations for the scope of the digital banking offer during the pandemic period were observed, but the risk of cybercrime during the pandemic was also pointed out. In its document "Systemic cyber risk" (ESRB, 2020), the European body for systemic risk presented a conceptual model of the development and materialization of cyber risk, as well as the factors of the emergence of a systemic crisis due to a cyber incident. Bearing in mind that since the pandemic period, the intermediary role of banks has been reduced, the banking sector operates in conditions of greater risk due to uncertainty during the pandemic. Digital banking service providers and application developers can take advantage of academic research to improve market share with the concept of service personalization. (Krishanan, et al. 2016).

In Serbia, the central bank made a decision to act in an economically proactive and preventive manner in the context of a worsening health situation. Banks responded by taking measures to continue operations, taking care of the unhindered performance of the bank's basic functions, as well as preserving the health of its employees. The author's research (Terkan, Ucar, 2020; NBS, 2021) opens a new view of distance learning, because most respondents have a negative opinion regarding the effectiveness and practice of distance learning. Banks have rapidly activated work-from-home options for the largest number of employees, cooperation and communication with customers takes place electronically and via video-conference calls, while on the other hand, bank clients are encouraged to use digital communication channels, including contactless payments (mobile by phone, via computer, payment cards) including payments with the recently introduced QR code at points of sale, for questions, consultations or sending documents to banks, it is recommended to use e-mail, social networks and banking contact center services. By reviewing the relevant literature and consulting official data, the analysis looks at the factors that can contribute to the banking sector being durable enough after the Covid-19 pandemic, to the financial system taking advantage of the current crisis situation and adopting a more sustainable form of business. The indicator of gross non-collectible claims (NLP) is still below the pre-crisis level and amounted to 3.6% in June, which indicates that the measures of the National Bank of Serbia and the Government were timely and that they prevented a larger negative effect on the economy and the population, and thereby also financial stability. Also, compared to the end of 2020, that share decreased (by 0.1 pp), with the economy sector 17% decreasing by 0.2 pp to 2.9% in June, and the population 18% to growth of 0.4 pp, to 4.0% in June (NBS, 2021). Back in 2018, the National Bank of Serbia introduced a system for instant payments, thanks to which payments are available to citizens and the economy 24 hours a day, seven days a week, throughout the year. Payment is possible from all commonly used modern communication devices, at any time and from any place, and money is transferred in 1.2 seconds (NBS, 2018). The effect that the pandemic can have on the financial system depends on: a) the further spread of the virus and its impact on economic trends, b) the reaction of monetary and fiscal policy to market shocks and c) the regulatory reaction to the possible collapse of the banking system (Beck, 2020).

Research methodology

The research methodology is aligned with the goals and objectives. The research consists of two parts. The first part refers to official statistical data for Serbia, and the second part includes empirical research.

Consequences of COVID-19 on the banking sector of Serbia

In the first part, the statistical data of NBS, Republic Institute of Statistics are used. By analyzing these data, we see the depth of the consequences of COVID- 19 on the banking sector of Serbia.

The Central Bank of Serbia was one of the first central banks in Europe to respond to the crisis caused by the pandemic in a timely and comprehensive manner with a series of implemented measures of fiscal, monetary and macroprudential policy, which acted in the direction of strengthening the stability of the financial system of the Republic of Serbia. Official data show that in Serbia, 78.4% of the population uses the Internet every day, and more than 50% of them access the Internet via mobile devices. Also, the number of mobile banking users has increased up to 20 times in the last six years. According to official data, mobile banking is used by more than 2.2 million people in Serbia (NBS, 2022). The first bank in Serbia that introduced mobile banking through smartphone applications is Banca Intesa, and in the world it is "JP Morgan Chase Bank" from the USA (Sanader, 2014).

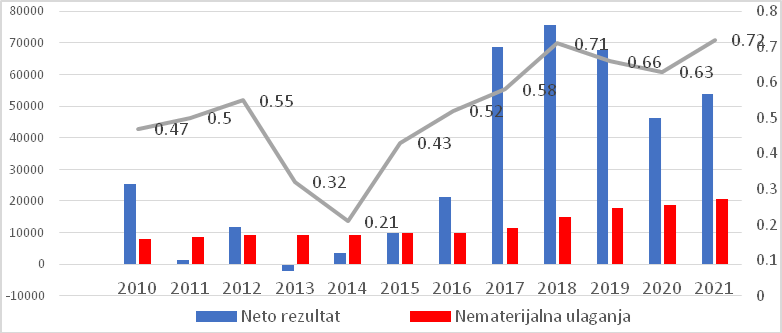

The next, logical step is the analysis of intangible assets. It is the only publicly available data on investment in IT technologies, innovation and digitization, as well as risk management, but the data is limited because it is cumulative data on software and licenses. The research results for the period from 2010 to 2021 are presented graphically (Figure 1).

Figure 1. Correlation coefficient of intangible investments and net results for the banking sector for the period from 2010 to 2021.

Source: Author's calculation based on data from the National Bank of Serbia.

The correlation between intangible investments and net results for the banking sector of Serbia is 0.74, i.e. medium strong correlation relationship and positive. The strongest correlation was achieved in 2018. According to the comparative data from the following graph, it is evident that there is a connection between intangible investments and net results. However, the correlation coefficient is decreasing despite increased intangible investments. It only confirms the influence of other factors that influence and burden the net result. A loss was also recorded in 2013, which arose as a result of the revocation of the operating license of two banks due to the high expenses of writing off placements. Due to the epidemic, clients were forced to turn to electronic and mobile banking, so the introduction of the IPS payment system before the outbreak of the epidemic additionally contributed to its popularization. On February 27, 2020, instant payment by QR code was introduced at points of sale, which all selected banks implemented in their m-banking applications.

Empirical research of clients' attitudes about the banking offer during the pandemic period

Of clients' attitudes about the banking offer during the pandemic period was conducted. To determine the satisfaction of clients with the banking offer during the pandemic, it is not possible to measure directly, but indirectly. Quantitative research was conducted using the method of surveying and interviewing on the population who are clients of the bank in the territory of central Serbia. This paper is based on the application of primary and secondary data. Primary data were collected through structured questionnaires. Data collection for this research was conducted in the period from January to May 2022. The research was conducted among the same group of people, i.e. researchers conducted informal interviews and surveyed exclusively clients of the Serbian banking sector.

The number of respondents was 200, of which 175 were valid survey questionnaires, which were used to calculate the importance of the parameter and purchase motive. In order to protect the confidentiality of the participants, the data is encrypted in the work. An appropriate scale was implemented in the research, which is also used by other researchers for the same purposes. The questions are closed-ended, with predefined answers. Data processing was created using the SPSS statistical computer package for social sciences.

The questionnaire consists of two parts. The first part of the questionnaire refers to demographic characteristics (The set of demographic questions includes: gender, age group, education of the respondents, work experience), and the second part of the questions aims to open important questions related to mobile banking, so that the obtained results contribute to a better understanding and evaluate the current state and offer of digital services by banking institutions. The questionnaire in the paper was developed using a five-point Likert scale. The questions in the survey questionnaire are structured in two parts, with answers expressed in grades from 1 to 5 (1- do not agree at all, 2. do not agree, 3- have no opinion, 4 - agree and 5- completely agree) The questions were formulated in such a way as to examine the attitudes of clients about the banking offer and which influence the motivation to purchase banking products and client satisfaction. (Gliem, 2003).

Research results

A total of 174 questionnaires (N=174) were available for statistical analysis. Among the respondents there were 56 female persons (97%) and 77 male persons (44%). Among them, 79 people under the age of 35 (45%), 53 people between the ages of 35 and 45 (31%) and 42 people over 45 (24%) were surveyed. The data show us that the young population dominates among clients. As far as the level of education is concerned, 108 people (62%) have a secondary level of education, 9 people (5%) have a lower education and 57 people have completed a higher school or university (33%). In terms of length of service, employees with up to 10 years of service dominate, 72 people (41%), followed by 54 people with up to 20 years of service (31%) and 48 people with more than 20 years of service (28%).

After examining the demographic characteristics, there followed an examination of the motivational attitudes that the respondents ranked according to their degree of importance for choosing a bank. Based on the homogeneity of variance test, we determine in which facilities the assumption of homogeneity of variance is not violated (Table 1). The most desirable convenience is: the price convenience of the banking offer (79%), the user experience (82%) and the reputation and image of the bank (79%), this means that there is a statistically significant difference between the mean values of the specific convenience. The lowest ranked convenience is the location of the bank (29).

Table 1. Test of homogeneity of variance

|

The most important reasons for choosing a bank? |

Levene Statistic |

df1 |

df2 |

Sig. |

|

Positive experiences of close people |

.565 |

2 |

45 |

.419 |

|

User experience |

5,509 |

2 |

45 |

.006 |

|

Bank location |

.369 |

2 |

45 |

.608 |

|

Price convenience |

7,532 |

2 |

45 |

.000 |

|

Reputation and image of the bank |

4.101 |

2 |

45 |

.013 |

Source: Author's calculation using the IBM SPPS program Statistics.

Out of 174 respondents, most respondents (59%) use mobile banking, 4% use a phone call, and 37% make a physical visit to the bank. By detailed segmentation of the responses, most of the respondents (42%) use the following banking products (bill payment, exchange rate calculator and insight into standing orders. The results of the frequency analysis show that clients use the mobile phone the most (89%), the dominant support is the guide through the application 52%, almost daily use of the Internet (79%), while the smallest physical visit to a bank branch is once a month at 37%. In terms of bank loyalty research, the majority of respondents have a defined attitude about changing banks, 73% if it does not meet their expectations.

The following is a set of questions intended to examine the importance of various factors in the pandemic period. Respondents were given the option of rating from 1-5, where 1- is not satisfied at all, and 5 is very satisfied. (Table 2.).

Table 2. Examining the importance of factors in the pandemic period

|

A row. Nu mbe r |

A research question |

EVALUATION |

||||

|

1 |

2 |

3 |

4 |

5 |

||

|

1. |

Are you satisfied with the price of the bank offer? |

6% |

26% |

29% |

32% |

7% |

|

2. |

Do you think you are protected from cybercrime? |

10% |

19% |

30% |

32% |

9% |

|

3. |

Are you satisfied with the courtesy of the bank staff? |

7% |

9% |

11% |

39% |

34% |

|

4. |

Are you satisfied with the promotion of the bank's business during the pandemic? |

1% |

6% |

23% |

38% |

32% |

|

5. |

How do you evaluate the user manual of your bank from the aspect of comprehensibility of application? |

3% |

5% |

8% |

35% |

49% |

|

6. |

How completely satisfied are you with the overall quality of the banking service? |

19% |

21% |

6% |

17% |

37% |

|

7. |

Are you satisfied with the expansion of the banking offer? |

20% |

36% |

19% |

16% |

9% |

|

8. |

Are you satisfied with the speed of the user interface? |

4% |

19% |

27% |

33% |

17% |

Source: Author's calculation using the IBM SPPS Statistics program.

We note that the majority of respondents, i.e. 32% are satisfied with the price of the bank's offer, 30% of the respondents do not believe that they are protected from cybercrime, 39% are satisfied with the courtesy of the staff, 38% are satisfied with the promotion of the bank's business and 35% are satisfied with the user manual from the aspect of comprehensibility of application. A very important research question is the quality of the entire banking offer because it is the most difficult service attribute to imitate and has a great impact on competitiveness. Answers according to this criterion have the most satisfied respondents (37%).

In further analysis, the statement that the proportion of respondents who have a negative attitude towards digital banking is less than 45% should be verified. We will perform the testing using the SPSS procedure " Non parametrizing test". The digital banking variable has two categories: 1st category of respondents who have a negative attitude towards digital banking and 2nd category of respondents who do not have a negative attitude towards mobile banking. The test result is shown in the table.

Table 3. Independent Samples Test

|

Independent Samples Test |

Category |

N |

Observed Prop. |

Test Prop. |

Exact Sig. (1-tailed) |

|

|

Digital banking |

Group 1 |

the others |

104 |

,59 |

,45 |

,000 |

|

Group 2 |

negative |

70 |

,40 |

|

|

|

|

Total |

|

174 |

1.00 |

|

|

|

Source: Author's calculation using the IBM SPPS Statistics program.

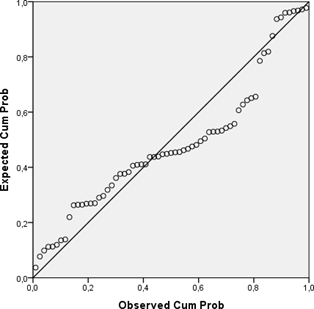

Based on the realized level of significance, we conclude that we accept the alternative hypothesis that the proportion of respondents who have a negative attitude towards mobile banking is less than 45%. The next picture (Figure 2) visually confirms the hypothesis of a normal distribution for the development of digital banking services.

Figure 2. Normality distribution diagram for standardized residuals

Source: Author's calculation using the IBM SPPS Statistics program.

Note: Dependent variable: Digital banking offer; Independent variable: Expected variable: price of banking offer, cybercrime protection, friendliness of staff, promotional activities, comprehensibility of user manual and speed of user interface.

It was proved that the normality assumptions of the regression analysis were not violated. The points lie in an approximately straight diagonal line from the lower left to the upper right corner of the diagram. Based on the scatter diagram, we conclude the following: according to the strength of the quantitative agreement, the connection between the entire digital banking offer and the other assumptions is statistical, of considerable strength, because the points are close to the imaginary direction that always passes through the point. Its shape is linear, the points are distributed approximately in the imagined direction, and its direction is direct and positive, i.e. with the growth of variables comes the digital banking offer. For the purposes of country-level research, it is possible to identify the digital maturity of the client.

Table 4. Digital maturity of clients by stages

|

Stages of maturity |

Digital maturity of clients |

% |

|

Information gathering |

Availability of information |

54 |

|

Account opening |

Opening process |

18 |

|

User involvement |

Availability of distribution channels of the banking offer |

63 |

|

Day-to-day banking |

Account and banking product management, authorization, card management, customer support, personal finance, transfers and payments |

51 |

|

Extended banking offer |

Cards, cash loan, check, bill of exchange, mortgage, accounts (foreign exchange, savings, term) |

28 |

|

Disconnection |

Closing the account |

21 |

Source: Author's calculation using the IBM SPPS Statistics program.

The survey results point to the client's perspective, which shows how customer satisfaction can be achieved by improving features and functionality. The least satisfaction (18) occurs due to the impossibility of opening an account remotely. On average, clients are satisfied with performing everyday transactions through digital channels.

Limitations of the research

There are certain limitations in this research. Given that the recommendation on contactless transactions was respected during the pandemic period, it is quite certain that digital distribution channels of the banking offer dominate. When answering questions that involve a Likert scale, there is a possibility that individuals have different perceptions of reality.

Conclusion and recommendations

The world economy will not be the same after the pandemic, which also applies to the banking sector as an inseparable part of the economy. Based on the analysis of research results based on statistical data, it is concluded that the pandemic left a deep mark on the banking sector of Serbia. The slight increase in the share of problem loans is a consequence of the negative effects of the pandemic and higher loan maturities after the end of the second moratorium on loan repayments, the negative effects of the corona virus pandemic on the financial markets in the first half of 2020, followed by an increase in the composite indicator of systemic stress and other indicators of financial health. The issue of client satisfaction with the banking offer in crisis conditions, including this pandemic one, is gaining particular importance. In practice, it is a real challenge to motivate customers to be loyal to the bank. There is no single solution, because clients are individuals, a personality in themselves with their own peculiarities, and the bank is a sui generis company, and competitive conditions are harsh. The attitude of the respondents is the most worrying, from the aspect of loyalty to the bank, because most of the respondents have a defined attitude about changing the bank, 73%, if it does not meet their expectations.

This study answered the main research questions that are supported in the literature. The results of these researches define the motivational approach of clients of the banking sector of the Republic of Serbia. Based on the results of the analysis, we conclude that the bank's clients are most attracted by the bank's price advantage, that they use mobile banking services, and among banking products, the most are bill payment, exchange rate calculator and insight into standing orders. We can state that the majority of respondents, 32%, are satisfied with the price of the bank's offer, 37% of respondents do not believe that they are protected from cybercrime, 42% are satisfied with the friendliness of the staff, 38% are satisfied with the promotion of the bank's business and 49% are satisfied with the user instructions from the aspect of comprehensibility applications. A very important research question is the quality of the entire banking offer because it is the most difficult service attribute to imitate and has a great impact on competitiveness. The answers according to this given criterion are positive and this is shown by the majority of satisfied respondents (37%). These studies show what activities should be undertaken in order for the banking sector to preserve its position and dynamize its activity. The results of this analysis only confirm the hypothesis that the banking sector must use the pandemic challenge as an opportunity to expand the range of its products and services, because 36% of clients are not satisfied with the expansion of the banking range, despite the quality offered for the current products. The increase in online trade and services that are approved "at a distance", as well as the introduction of new services such as video onboarding, account transfer and fund transfer via mobile phones, show the willingness of banks and regulators to modernize the Serbian financial market and bring it into line with the latest trends in Europe..

The massive shift to digital services and the rethinking of old business habits will accelerate digital competitive dynamics. In order to survive and fulfill their mission, banks will have to adapt to the new circumstances. In order to accelerate the digital transformation of banking operations, bank managers should focus on the following priorities: Banks should choose a strategic priority through the creation of new revenue streams, cost reduction and improvement of user experience. Technological and organizational capabilities should be established both on the supply side and on the demand side. On the supply side, the bank should manage its sales distribution channels. By creating interfaces, such as app stores, they should be accessible to users through easy access, including the speed of the registration process, authentication, and pricing guidelines. Bank managers in Serbia should create a more favorable working environment. Bank managers should take more measures to support their employees. Banks should continue professional development of their employees through webinars, digital courses in order to provide better services to clients. The COVID-19 pandemic has forced banking customers to embrace digital banking products and services remotely. Focus on the client can be improved through 1. adapted banking offer to digital products, services and operations, 2. adaptation in terms of existing lines of business to relevant customers in accordance with existing regulations and 3. implementing innovations in the form of new, better and safer digital solutions and better user experience. The more equipped the bank is, the more trust clients have in it. The results of the conducted research show that digital transformations have an upward trend and are changing the image of traditional banks. The most obvious benefits for the client are from accessing the service to seeing the effects of the digital transaction. It remains an open question for bank managers, whether the banking sector will be more resilient in the future and how much digitization will accelerate the process of economic recovery, as well as how to improve the digital banking offer.

References

2. AtKearney, E. 2014. Going Digital: The Banking Transformation Road Map. (available on the website: https://www.atkearney.com/).

3. Bozovic, J. 2016. Mobile banking in Kosovo and Metohija - Status and Potential. Journal of Research in Business, Economics and Man, 5(2): 531-

542. (available on the website: http://www.scitecresearch.com/jouragementnals/index.php/jrbem/article/view

/561).

4. Beck, T. 2020. Finance in the times of coronavirus. In: Baldwin, R. & Mauro, BW (eds.) Economics in the Time of COVID-19 (pp. 73-76). London: Center for Economic Policy Research.

5. Darjana, D., Wiryono, SK and Koesrindartoto 2022. The COVID – 19 Pandemic Impact on Banking Sector, Asian Economics Letters, Vol 3. (31). (available on the website: https://ael.scholasticahq.com/article/29955-the- covid-19-pandemic-impact-on-banking-sector).

6. Ercegovac, R. 2002. Financial assumptions of economic growth in transition economies, Proceedings of the Faculty of Law in Split, 39 (3-4): 491-502.

7. ESRB. 2020. European Systemic Risk Board, Systemic cyber-Risk, February 2020. (available on the website: https://www.esrb.europa.eu/pub/pdf/reports/esrb.report200219systemiccyberr isk~101a09685e.en.pdf?fdefe8436b08c6881d492960ffc7f3a9)

8. Gavrilović, K., and Vučeković, M. 2020. Impact and Consequences of the COVID-19 Virus on the Economy of the United States, International Review, No. 3-4: 56-64.

9. Gertler, PJ, Martinez, S., Premand, P., Rawlings, LB and Vermeersch, CMJ 2011. Impact evaluation in practice. World Bank.

10. Gliem, JA, and Gliem, RR 2003. Calculating, interpreting, and reporting Cronbach's alpha reliability coefficient for Likert-type scales. Midwest Research-to-Practice Conference in Adult, Continuing, and Community Education.

11. Haldar, A., and Sethi, N. 2021. The news affects Covid-19 on the global financial market volatility. Bulletin of Monetary Economics and Banking, Special Issue 2021, 33–58.

12. Jaubert, M., Marcu, S., Ullrich, M., Malbate, JB, and Dela, R. 2014. The banking transformation roadmap. (available on the website: https://www.kearney.com/financial-services/article?/a/going-digital- thebanking-transformation-roadmap).

13. Krishanan, D., Khin, AA, Teng, KLL and Chinna, K. 2016. Consumers' Perceived Interactivity & Intention to Use Mobile Banking in Structural Equation Modeling. International Review of Management and Marketing, 6 (4), 883–890. (available on the website: https://econjournals.com/index.php/irmm/article/view/3202).

14. KPMG, 2020. New distribution channels reconfiguring the banking landscape, London.

15. Lightico. (available on the website: https://www.lightico.com/blog/coronavirus-covid-19-and-the-banking- industry-impact-and-solutions/).

16. WHO Coronavirus Disease (COVID-19) Dashboard, World Health Organization. (available on the website: https://covid19.who.int/, accessed on 16 July 2020).

17. Narayan, PK 2020. Oil price news and COVID-19—Is there any connection? Energy Research Letters, 1 (1), 13176. (available on the website: https://doi.org/10.46557/001c.13176).

18. National Bank of Serbia (NBS). Annual reports on monetary policy. (available on the website: https://www.nbs.rs/export/sites/NBSsite/documents/publikacije/mp/monetarn apolitikaI2021.pdf).

19. Radić, V. and Radić, N. 2020. Factors that will shape business strategies after the corona virus pandemic, Quality & Excellence, 2020 (11-12), 36-41.

20. Ramasamy, K. 2020. Impact analysis in banking, insurance and financial services industry due to covid-19 pandemic. Pramana Research Journal, 10, 8,19-29.

21. Racickas, E., Vasiliauskaite, A. 2012. Classification of Financial Crises and their Occurrence Frequency in Global Financial Markets, Nr. 4, Kaunas University of Technology

22. Rizwan, SM, Ahmad, G., Ashraf, D. 2020. Systemic risk: The impact of COVID-19. Finance Research Letters, ISSN 1544-6123. (available on the website: https://doi.org/10.1016/j. frl.2020.101682 PWC (2020) COVID-19 - Economic response measures).

23. Sanader, D. 2014. Mobile banking: a new trend in the modern banking sector, Bankarstvo, (5), 86-109.

24. Taylor NR 2018. “Bank of America finally sees mobile deposits surpass in- person transactions,” The Street. 2018 (16).

25. Terkan, R., and Ucar, O. 2020. The Relationships between Information and Practices of Teaching Staff that Give Courses at Educational Programs during the COVID 19 Pandemic with Regards to Distance Learning. International Review of Management and Marketing, 10(6), 29–36. (available on the website: https://econjournals.com/index.php/irmm/article/view/10765).

26. Thomas, D. and Morris, S. 2020. A giant bonfire of taxpayers' money: fraud and the UK pandemic loan scheme, Financial Times, London.

27. Twilio, 2020. COVID-19 Digital Engagement Report, San Francisco.

28. World Bank. (available on the website: https://documents1.worldbank.org/curated/en/965271619455150688/pdf/Sub dued-Recovery-Serbia-Country-Note.pdf).

Published in

Vol. 9 No. 1 (2023)

Keywords

🛡️ Licence and usage rights

This work is published under the Creative Commons Attribution 4.0 International (CC BY 4.0).

Authors retain copyright over their work.

Use, distribution, and adaptation of the work, including commercial use, is permitted with clear attribution to the original author and source.

Interested in Similar Research?

Browse All Articles and Journals